Your medical practice is diligently collecting payer contracts, finding reps, analyzing the good and recognizing the bad, so what is next?

Along with these tasks, you should seek to understand your value in the network. Know your ratings on Google, review platforms like RateMDs and ZocDoc, and work to differentiate yourself and bring added value to the payer network. What do you do that the payer would appreciate, outside of how big you are or the revenue you generate? Do you keep people out of the ER? Do you have office hours that patients appreciate? Work to build added value.

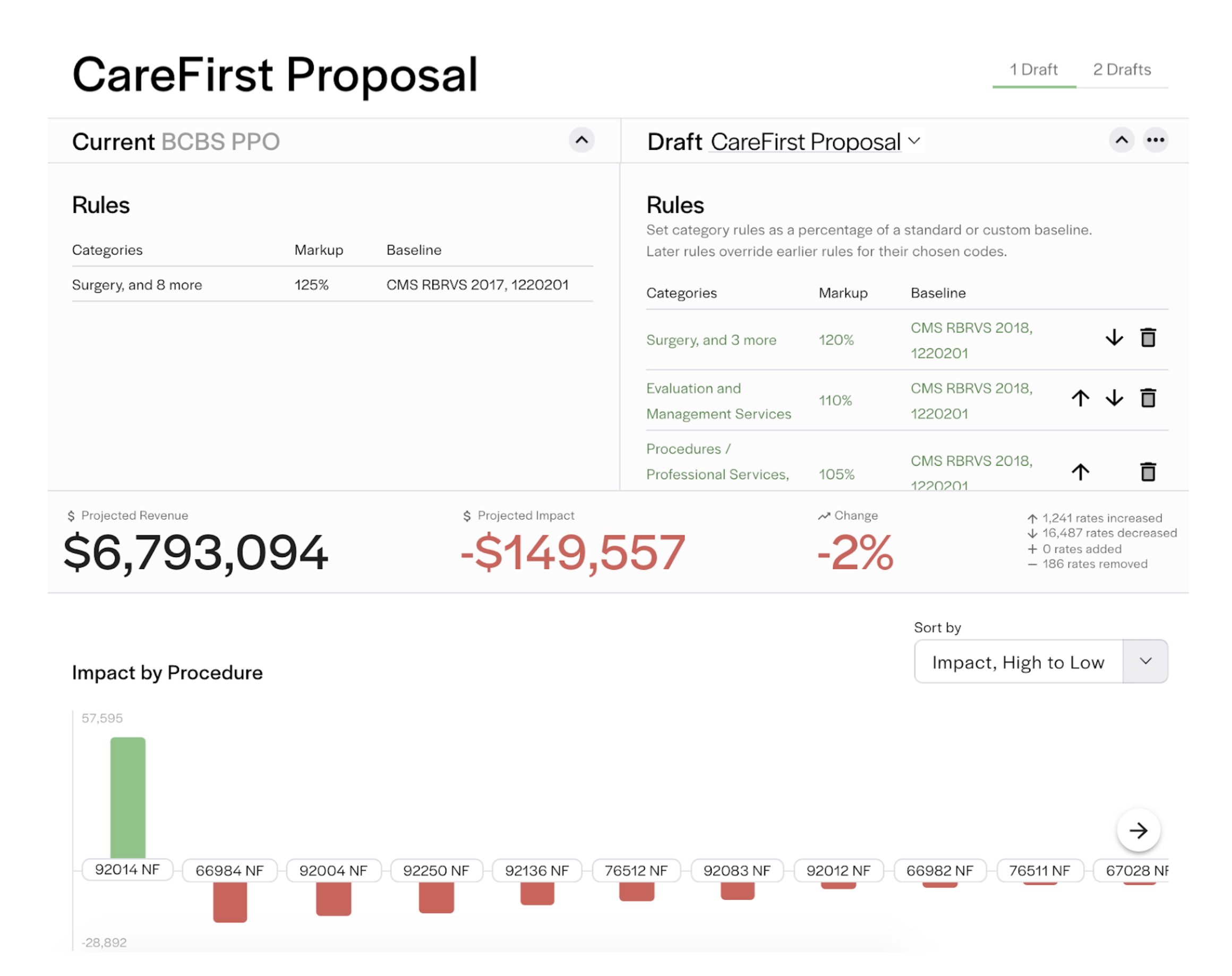

Now that you have compiled your contracts, you’ll want to know how they are going to affect your revenue. Modeling can play an important role in developing strong payer contracting strategies, but often goes undone. At Rivet, our fee schedule modeler (below) compares current fee schedules to a proposal or other scenario. It also helps you to know when a fee schedule will not benefit you so you can push back at the negotiation table.

When considering a model to apply to your contracts, it’s helpful to know what makes a model successful. We recommend considering the 3 A’s:

The most common pricing methodology is % of Medicare - but is that really the best way? Medicare is traditionally a lower fee schedule, meaning you are likely taking a lower fee schedule and doing a higher markup than is necessary. Plus, some commercial payers may have higher rates, 150% or 200% above of your Medicare rate. You might be leaving money on the table by setting prices at that fixed rate.

Contract and reimbursement data is one of the only proprietary factors that differentiate insurance carries across networks, making it extremely valuable. The payer contract language determines what providers are in-network with that insurance carrier, and the reimbursement rate determines what they are paying out which drives operating margins.

Once you have compiled your payer contracts, put them to work. Understanding what they entail can make a difference in all aspects of your practice, from accounts receivable to patient satisfaction. Plus, recognizing the good and the bad in your contracts will empower you to make more informed decisions, building a strong foundation for success at your practice.

To help, Rivet can perform a pricing optimization report that looks across all fee schedules for the highest rate associated with that fee schedule. We’ll then tell you what a good buffer price would be for that CPT code and help you be strategic in how you are pricing. In addition, we’ll perform a small markup above the highest reimbursement rate to reduce the amount of contractual adjustments. Overall, this report will tell you if your prices are below any fee schedule (triggering lesser-of clause) and help you set your charge with a strategic defensible methodology.

Discover how Rivet can streamline practice management by scheduling a demo. Rivet’s revenue cycle management (RCM) tools support practice revenue with payer contract management software and that compares contracted rates and more..

For more resources on compiling and understanding payer contracts:

Article: All Payers are not Created Equal