You’re leaking cash. Why is it OK to flush your revenue down the drain? It’s not. But it’s hard to find the cash flow leak when you are in the dark.

That is where Rivet comes in. Think of us as the bright light you need to rescue your lost revenue. Since we are tailor-made for denials management process and other claim resolutions — we solve the healthcare claims issues from the ground up as an easy, to use, intuitive and highly customizable workhorse. With flexible team work lists, easy filtering, batch workflows, and personalized denial processing documentation we help you conquer one-off problems as well as systemic denial trends. Legacy systems were not built to deliver this way. In the end we help you rescue your money — and the kicker — you get to keep 100% of your recovered dollars — no percentage fee collections.

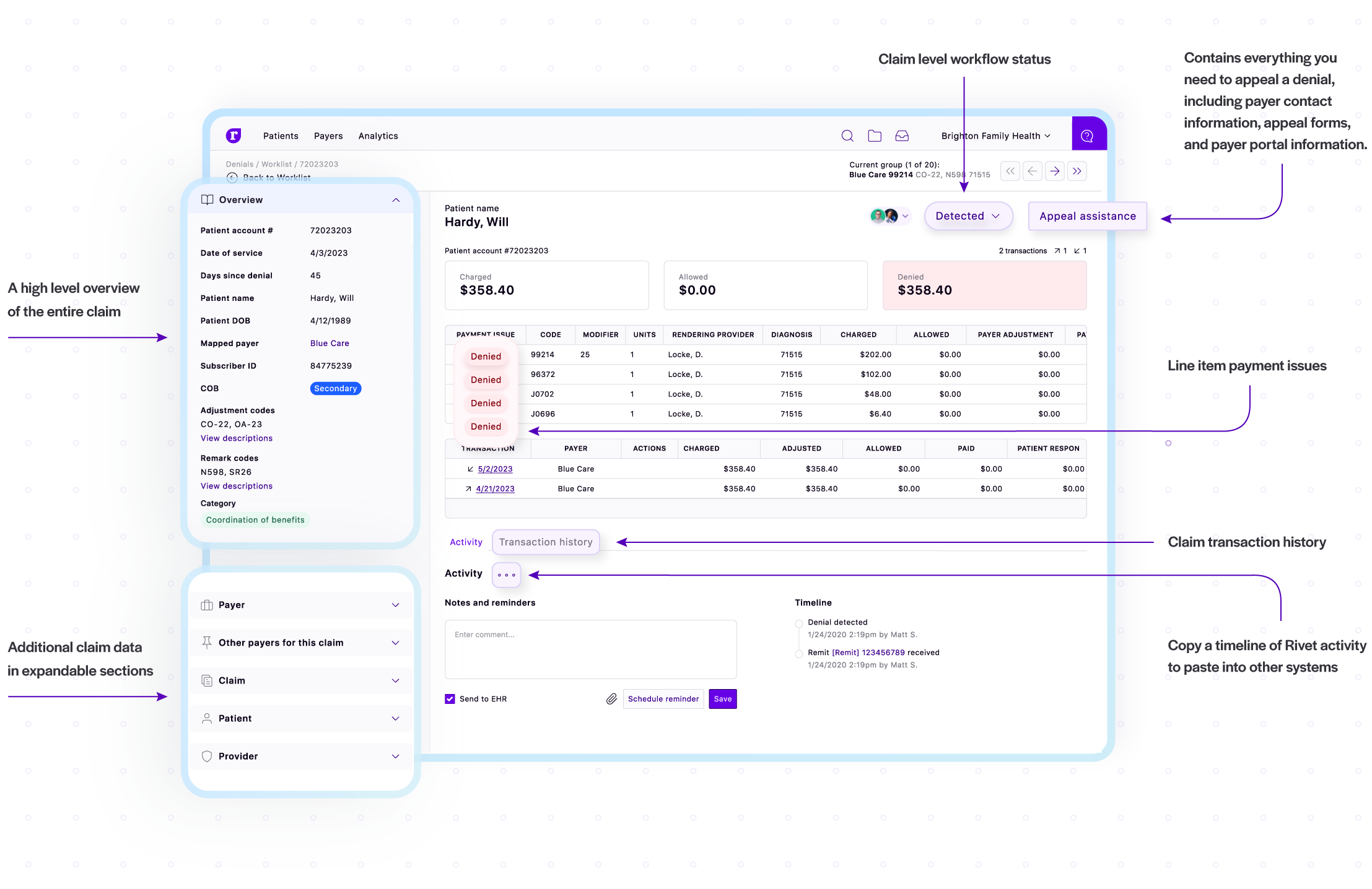

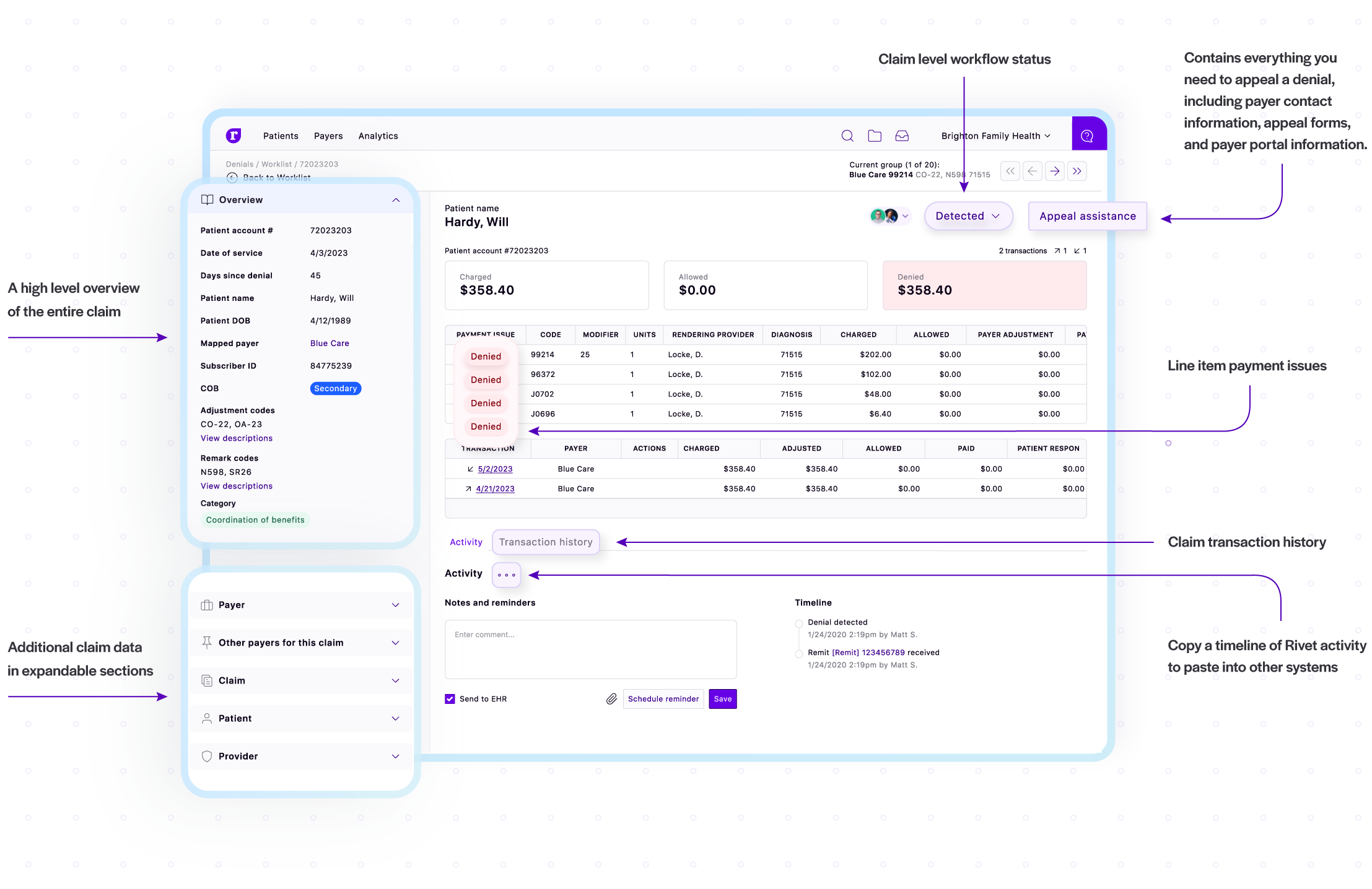

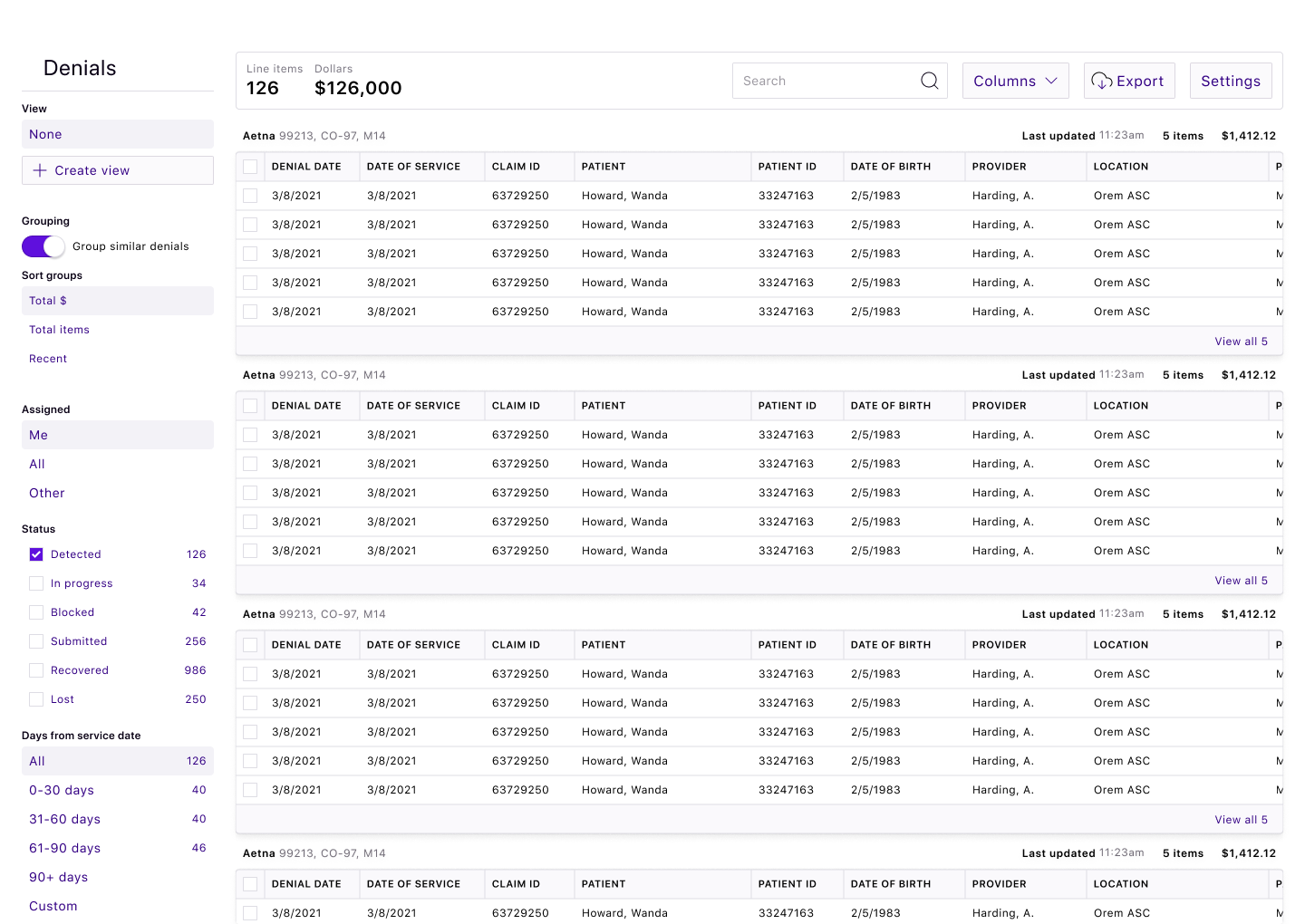

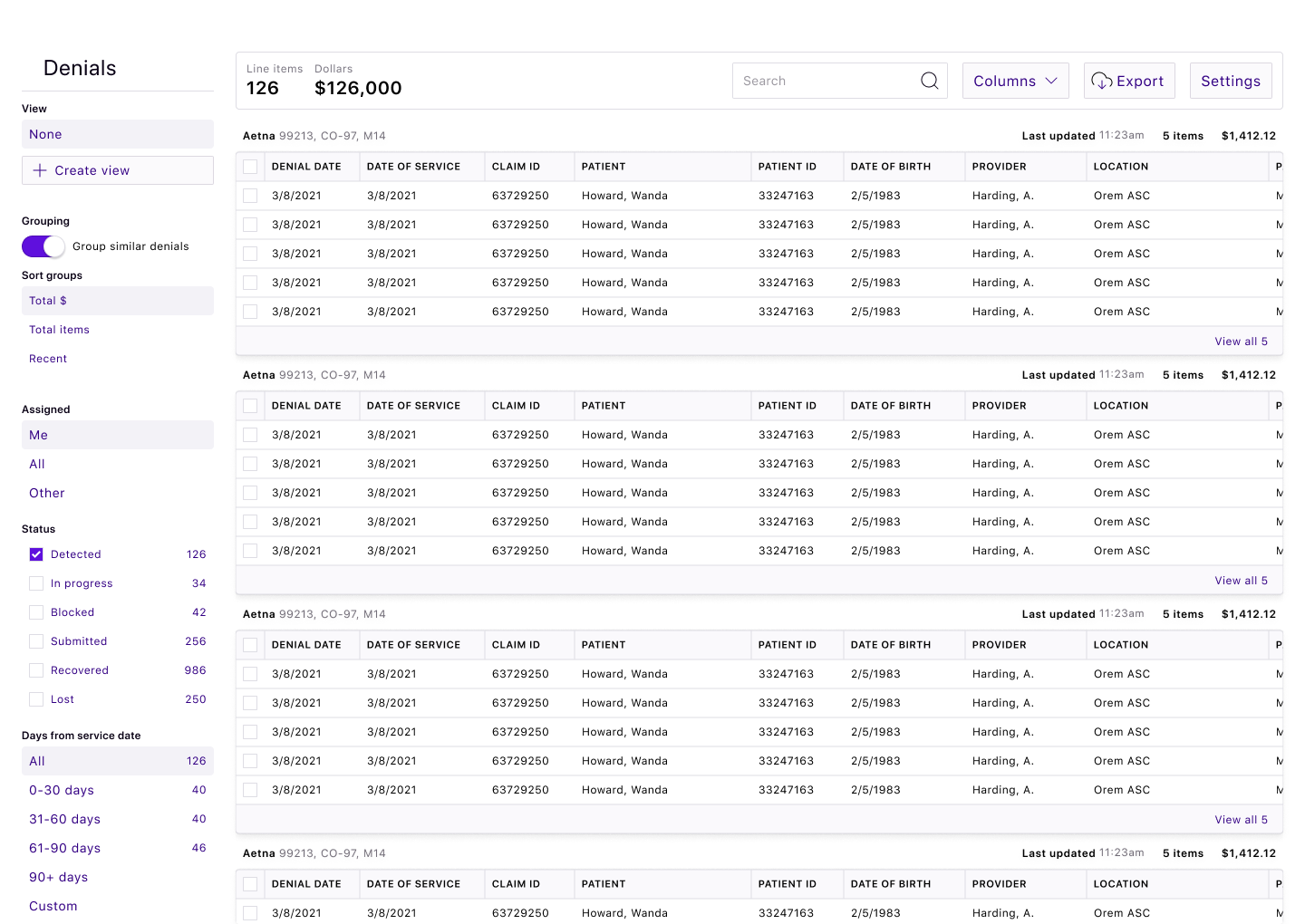

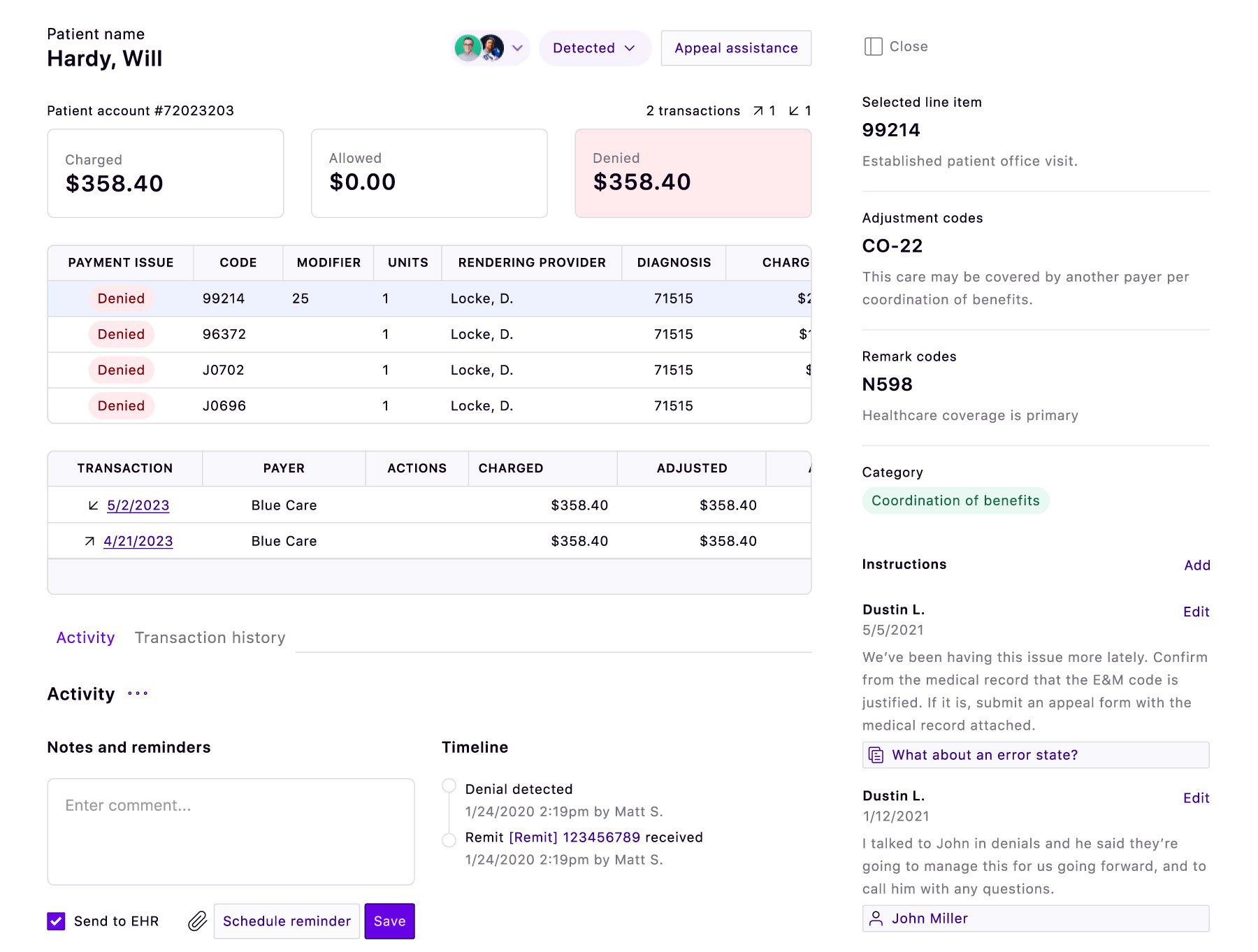

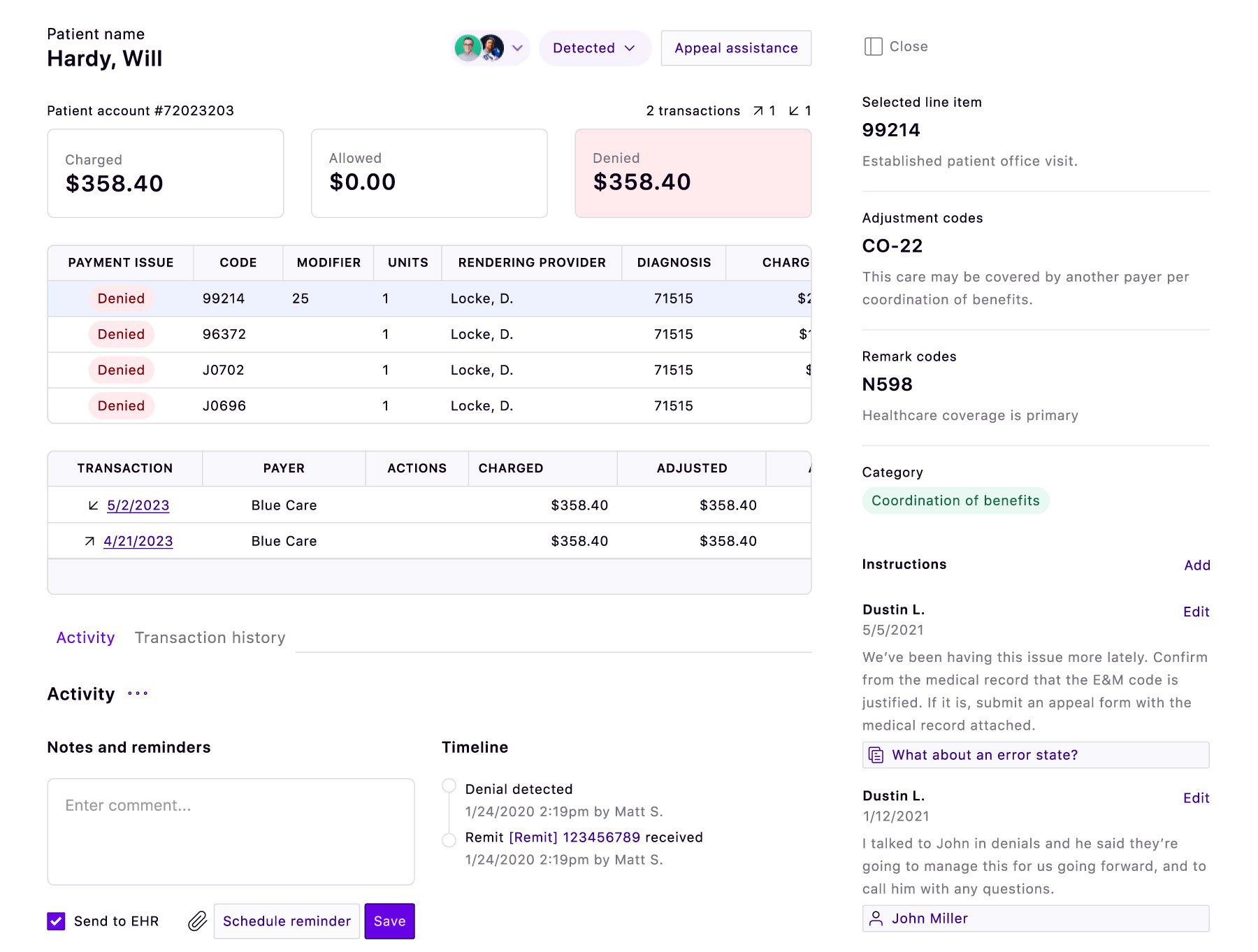

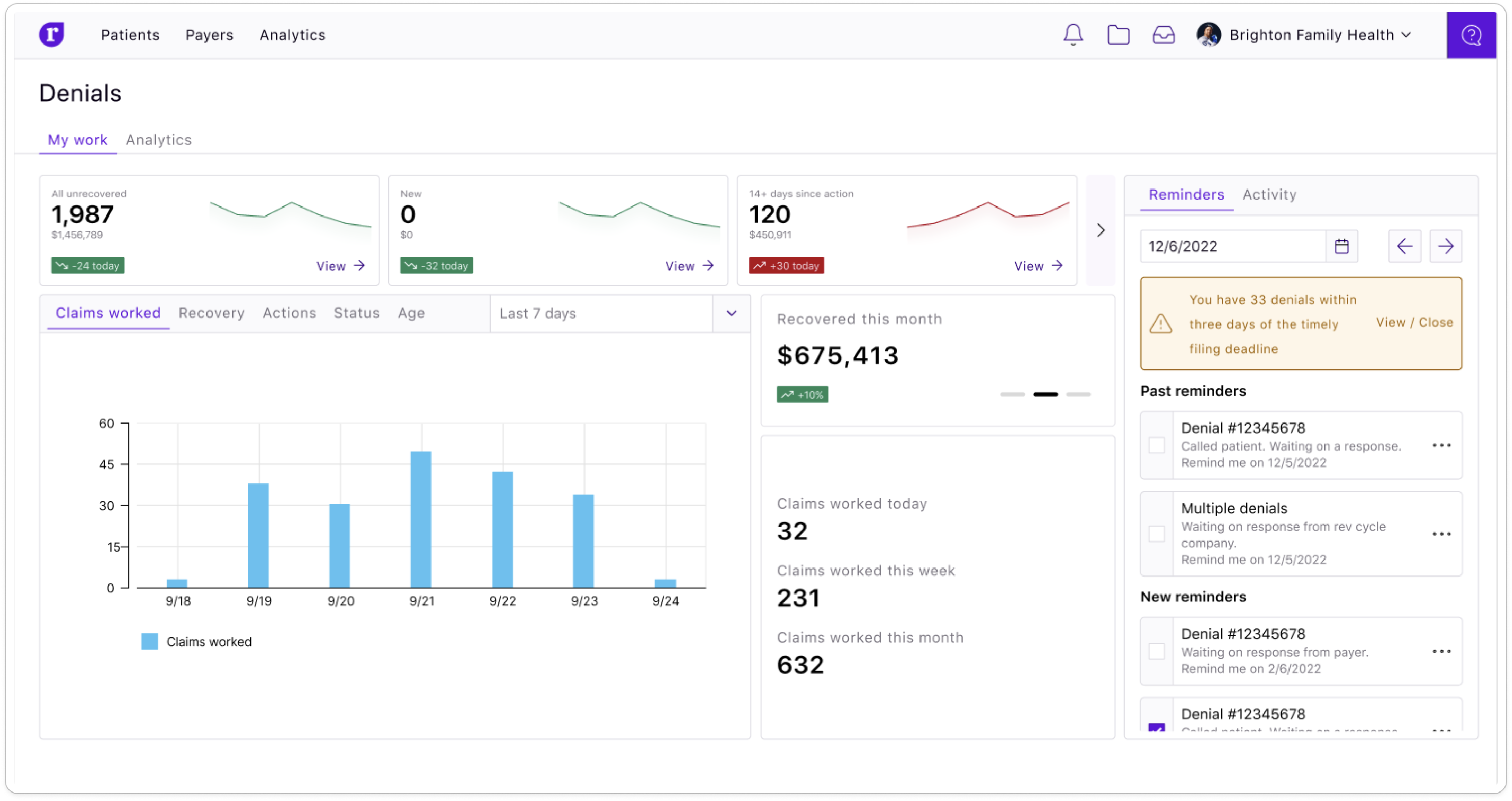

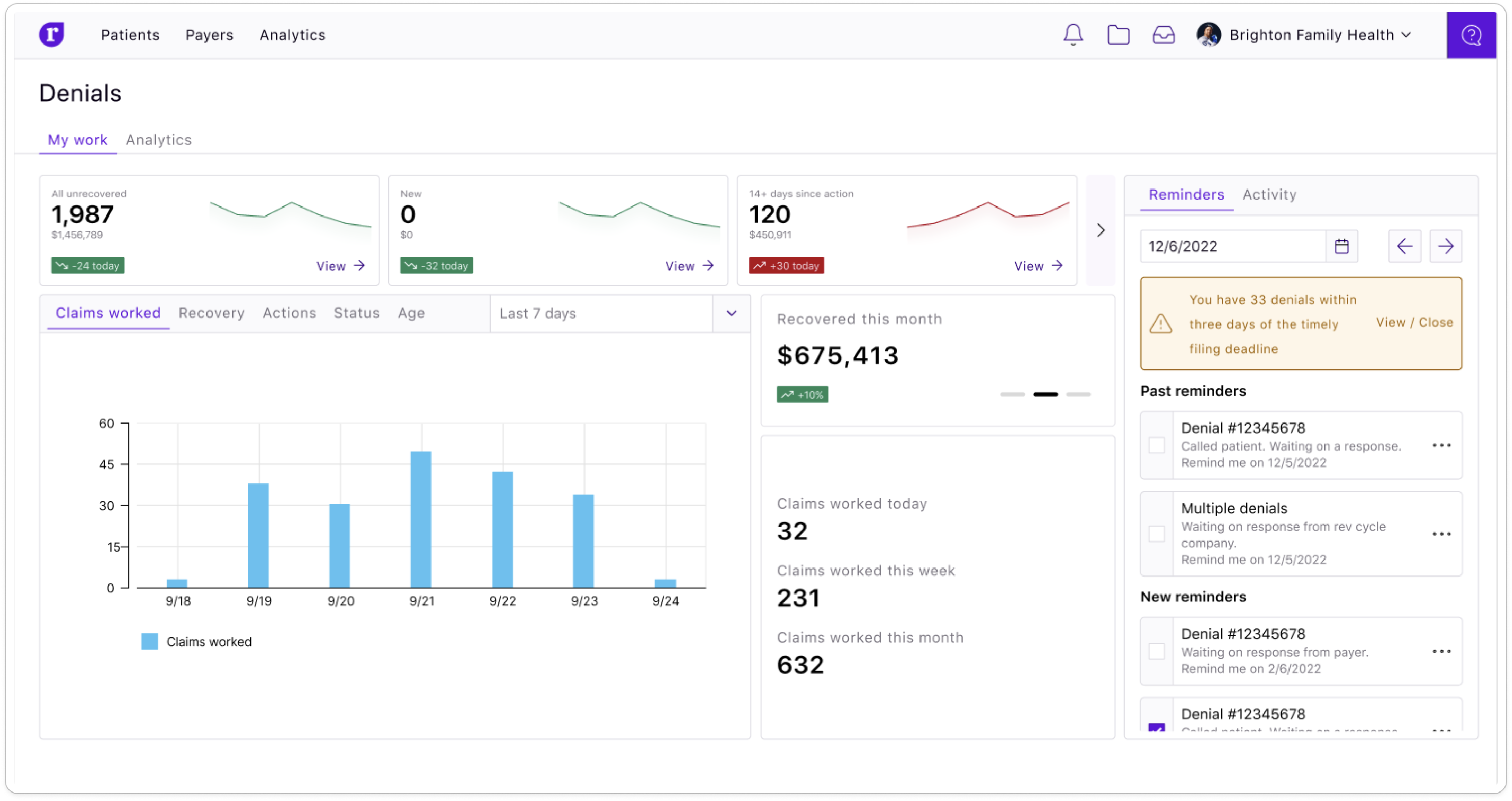

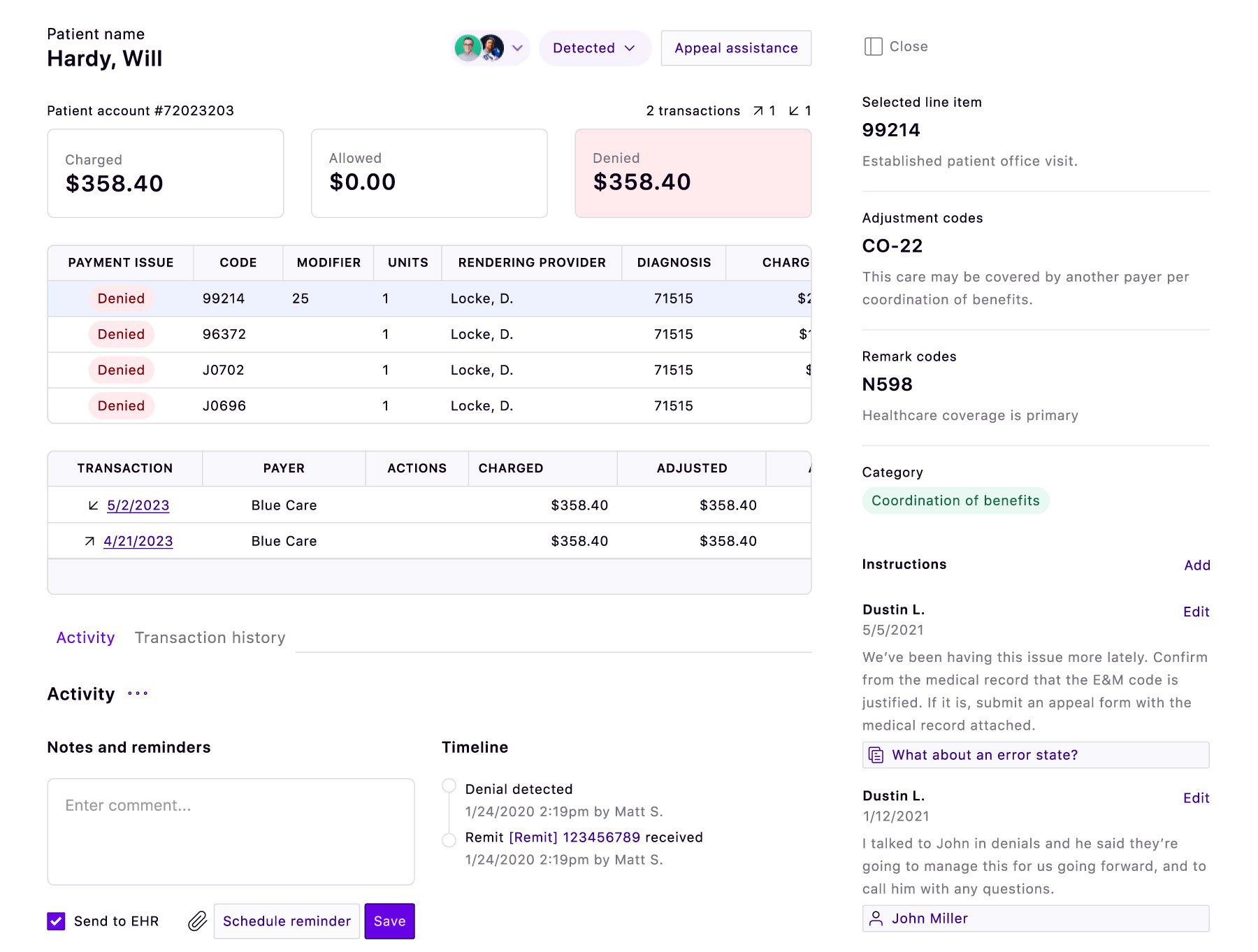

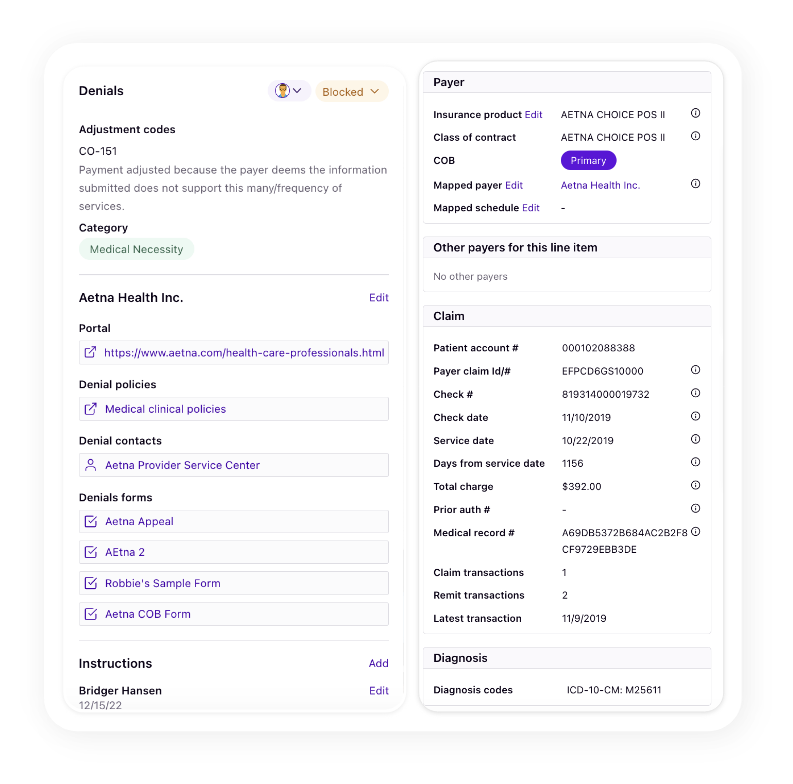

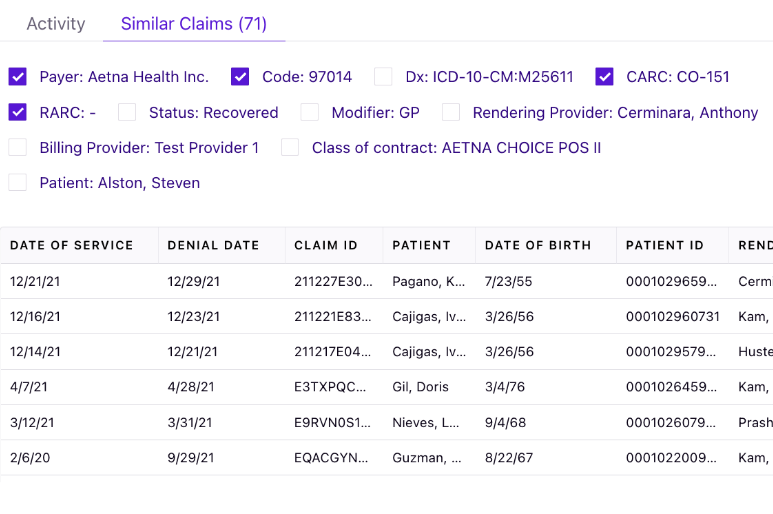

Easy, personalized worklists, custom filtering and a simple, smart design lets your team of one or more experts perfect their denial management workflow to make the most of their time. Hunting for answers is minimized while the ability to process more denials with the same team is maximized.

Since turnover and understaffing are constant issues in healthcare organizations, Rivet provides a formalized learning ground to help your newest team reps consistently adhere to best practices for denial management. You can retain and document expert knowledge to assist new teammates to optimize the denial management process denials like a pro. Your proven processes are not only documented with a specific type of denial, they are also attached to similar denials in the workload. Automation simplifies processes and eliminating repetitive tasks.

With Rivet on your side, your team’s efforts are multiplied, their denial management processes streamlined and their abilities amplified. And the best part is when you recover the denial owed to you — it all posts to your account, without a percent lost to collections.

“We work claims in bulk based on upcoming timely filing dates. I love that Rivet gets rid of the guessing and research on my end and streamlines my processes so we could recover $1.2M in 10 months.”

Debra Sanders

Patient Account Representative

“We’re so on top of our denials,” she said, “we’re getting claims off of our reports before they can even hit our reports. We’re no longer seeing denied claims become 180+ days old.”

Shantelle Knight

Insurance Processor Services Trainer

“Before Rivet we’d work about 30 appeals a month. I essentially worked about 300 in about 4 days.”

Data Analytics/Informatics Manager

Indiana neurology practice

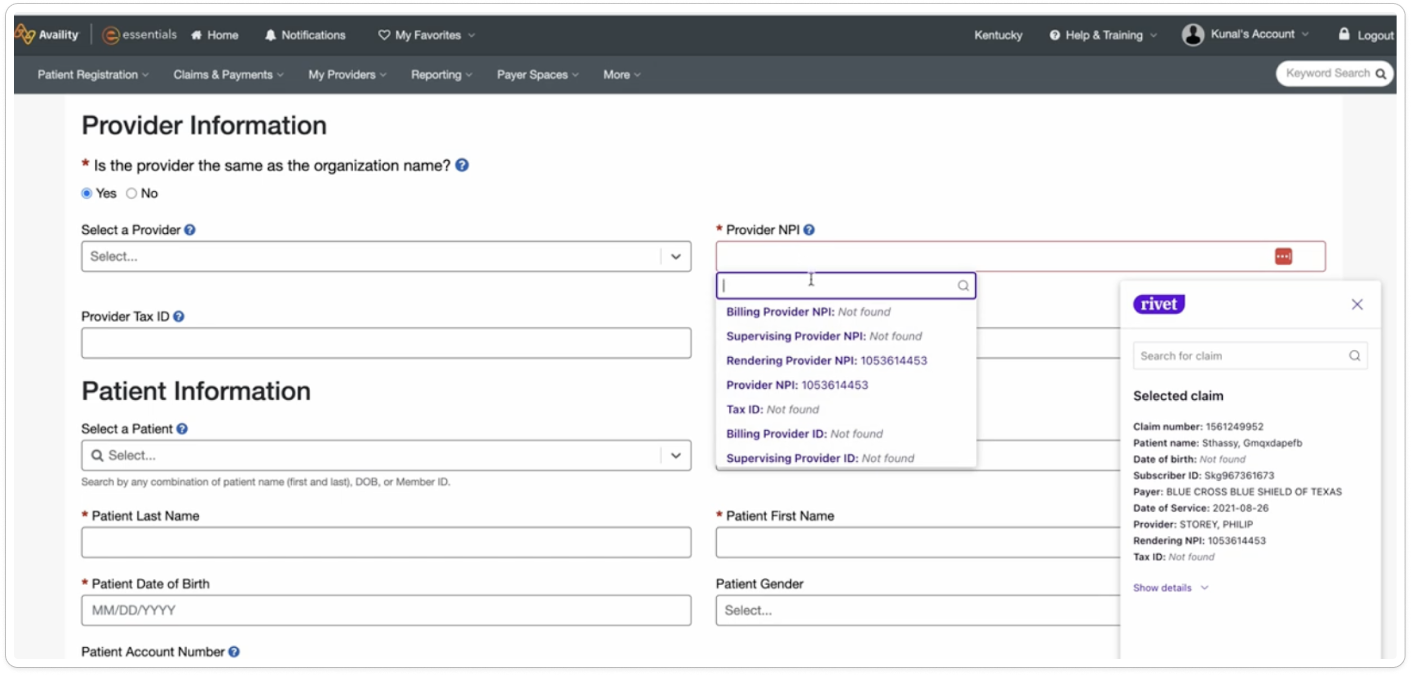

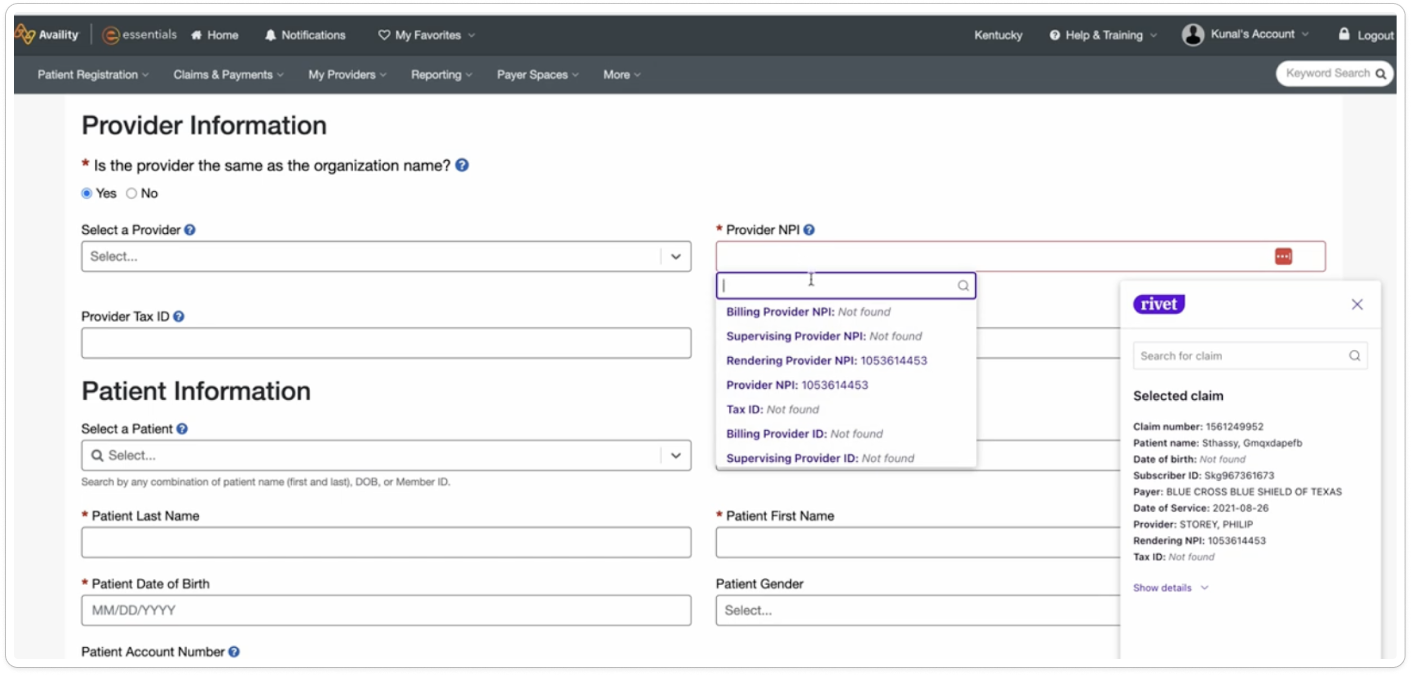

“Everything I need to work a claim is in Rivet. I can analyze an individual claim without jumping through hoops and going through the payer’s website. It’s all there for me. I can customize my worklist and my team can customize theirs. I work entire lists of denials in Rivet and resubmit claims to payers in bulk. I don’t have to worry about keeping my list up-to-date because Rivet does all the heavy lifting. We’ve saved so much time and energy when it comes to reworking claims. With Rivet, we’re working smarter, not harder.”

Angela Phillips

Medical Billing Specialist

Denial management software automation includes claims analysis to understand root causes, predict revenue impact, prevent future denied claims, and speed up recovery. Rivet denial management offers automated and customizable reports in a matter of seconds, billing edits to combat autogenerated denials, and revenue recovery for denial workflow assistance. Download any of the reports, charts, and tables for a presentation, training, or further investigation. Dispel the manual data entry needed to fully deep dive on claim issues.

The average claim denial rate in healthcare varies, but it generally falls between 5% and 15%. Some sources suggest an industry average around 10%. However, denial rates can fluctuate significantly based on factors like payer type, plan type, and the specific healthcare provider. Some Medicare Advantage and Medicaid managed care plans have been reported to have denial rates higher than the average. On average, Rivet customers lower their denial rate by 40% or more through Rivet denials management and prevention.

Billing errors, coding inaccuracies, lack of proper documentation, and authorization problems can cause denials and improper reimbursement. Rivet denial management software prevents denials through AI powered analysis and billing edit suggestions to outsmart insurance auto denials. Rivet also assists in speedy revenue recovery and audits current and historical claims for improper reimbursement.