This is an excerpt from Rivet's Revenue Cycle Webinar Series. To watch the full webinar, click here.

As healthcare workers, we know that collecting is hard, and as high-deductible health plans increase and more expenses are placed upon the patient, the process will only become more difficult. In fact, a recent quote in a medical economic journal said that “Collecting from patients will continue to be a threat to the independent physician practice.”

Knowing that this threat is imminent, it’s critical that practices work to create systems for collecting up-front payments that think outside of the statement-only collections process in order to meet the challenges of the changing landscape.

There are a number of reasons that collecting from patients is a challenge, especially for independent practices, including the “bill me later” mentality in healthcare. This mentality occurs because many practices don’t have the tools in place to create an educated estimate so they default to sending a bill later. In fact, 81% of physician practices have expressed difficulty communicating patient payment accountability, which only serves to enable this mentality.

Even worse, the difficulty seems to be becoming systemic in nature. Since 2008, general annual deductibles for covered workers have increased eight times as fast as wages, and 83% of physician practices under five practitioners said the slow payment of high-deductible plan patients are their top collection challenge.

These ballooning deductibles are making it more difficult to collect, resulting in more bills being sent to the patient. So, as the landscape changes so should your processes. Adopting consumer-friendly payments that disrupt the ineffective strategy of statement-only collections is a great place to start. In fact, ⅔ of patients say that they prefer electronic payment methods to pay their medical bills. Making it easy for patients to pay is key, along with helping patients to better understand their bills.

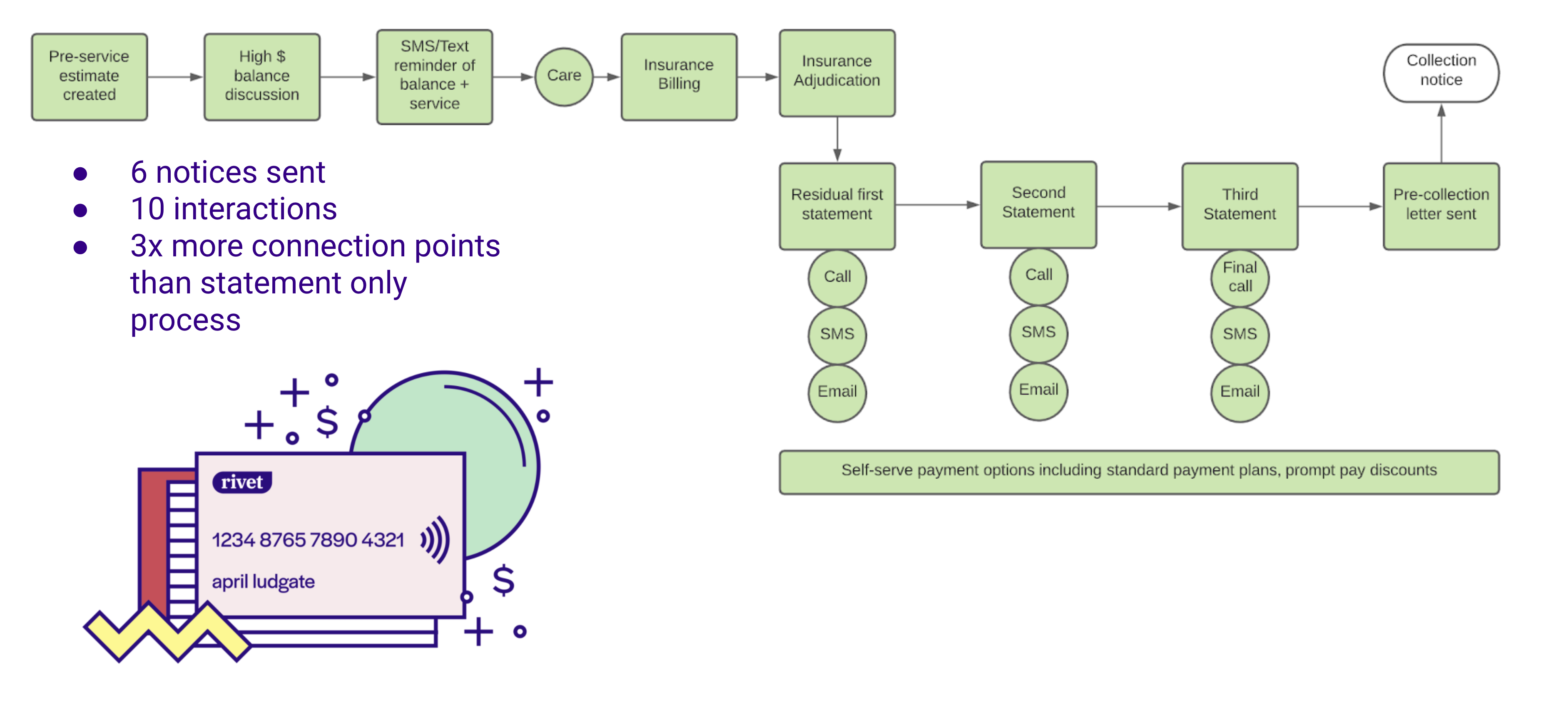

Creating an effective process for collecting up-front payments requires can be effective, but it requires thinking outside of the norm. When this is done successfully, the results will be an acceleration of the collections timeline, greater patient satisfaction, and fewer aged accounts. An example of a more radical approach might look something like this:

In this example, the up-front component is very valuable. An estimate is created that is paired with benefits/liability as well as network allowables, and a variety of communication platforms are employed.

Communicating effectively with patients is key to successfully processing up-front payments. However, not all patients are created equal when it comes to communication and different demographics of patients prefer to communicate in different ways (i.e. text, online portals, phone calls, statements, etc.). Luckily, there are a number of solutions for communicating easily with patients across age groups.

Before determining the best communication approach for your patients, it’s important to consider the following:

Cash is still king and the more of it that you can collect up front, the better. The key to doing this successfully is creating a strong patient estimate that patients can pay up front. For more help creating an estimate, visit our blog post, Delivering an Up-front Patient Cost Experience.

Shameless Rivet plug: Rivet provides the most accurate patient cost estimates on the market. Learn more here.

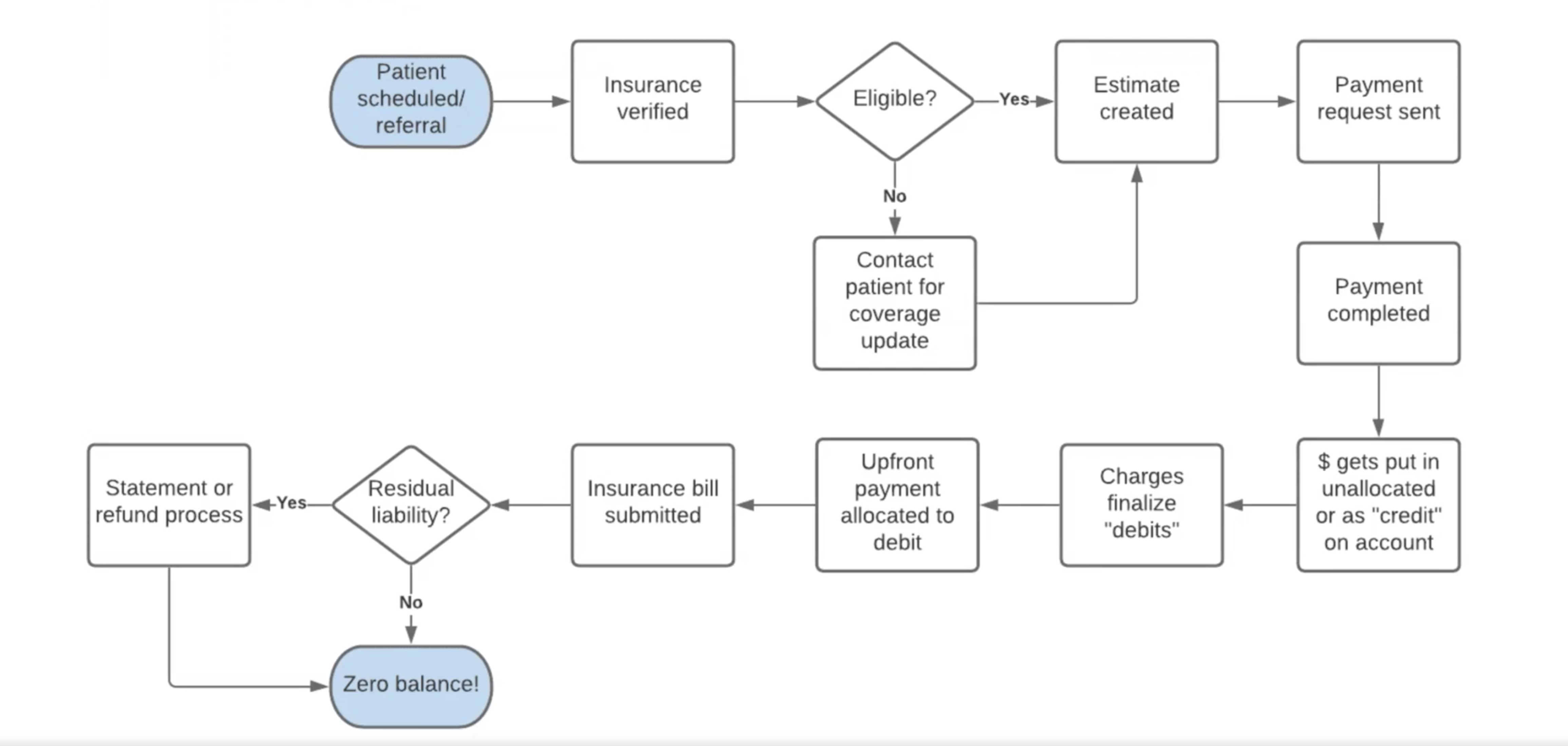

The goal of a successful estimate is to empower patients to manage the bulk of the financial responsibility up front so in the end, reconciliation of the account yields a positive experience (i.e. a smaller final bill, a refund sent, etc.). An example of the reconciliation process might look something like this:

Additionally, up-front payment and successful reconciliation will result in the following added benefits:

Working to improve your strategy for processing up-front payments is a great starting point for strengthening your patient collections practices in this changing financial landscape.