Revenue reporting can waste hours of time searching, compiling and re-checking data. The tools from your clearinghouse and EMR only do half the job - and their reports can differ, making results untrustworthy. In addition, most reports are made at a stagnant point in time and not up to date when you need them, creating more work and wasted time.

Rivet Revenue Diagnostics offers customizable and filterable views of your data in visually dashboards - showcasing what you want to see - whenever you need it (now). With data-driven insights you can achieve sustainable revenue growth and thrive in the ever-changing landscape of healthcare finance. Dive in and drill into real-time reports to get the answers you need to build the business you want.

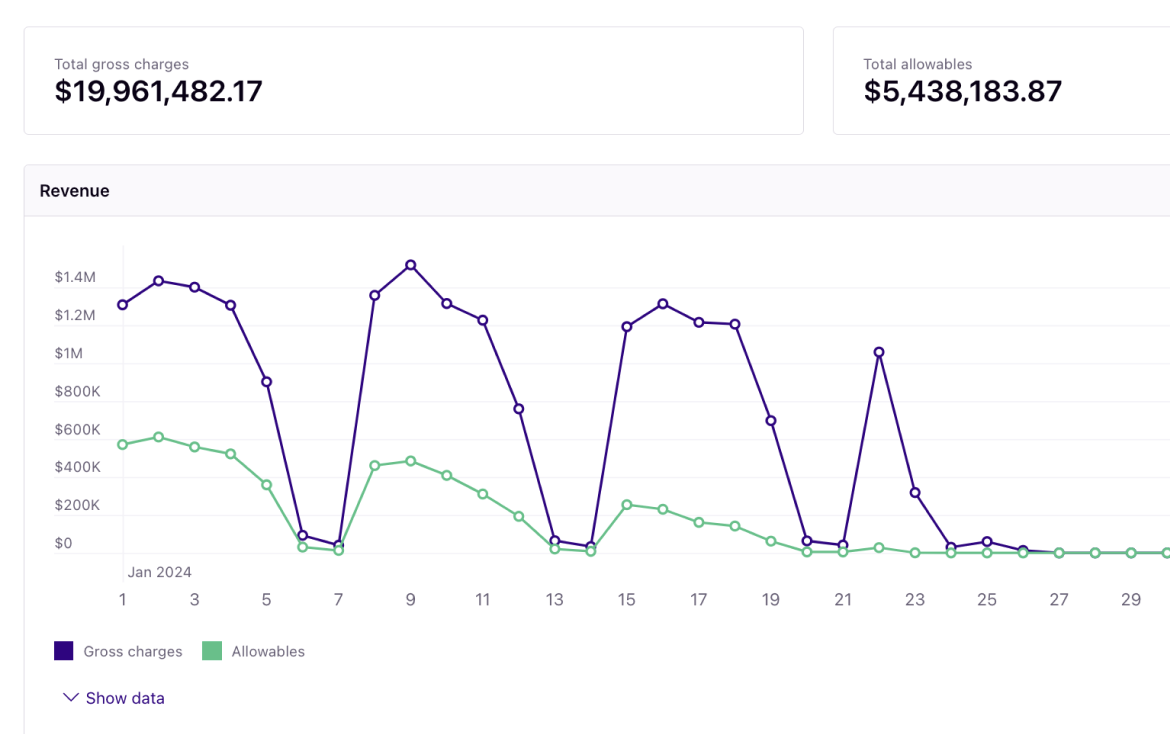

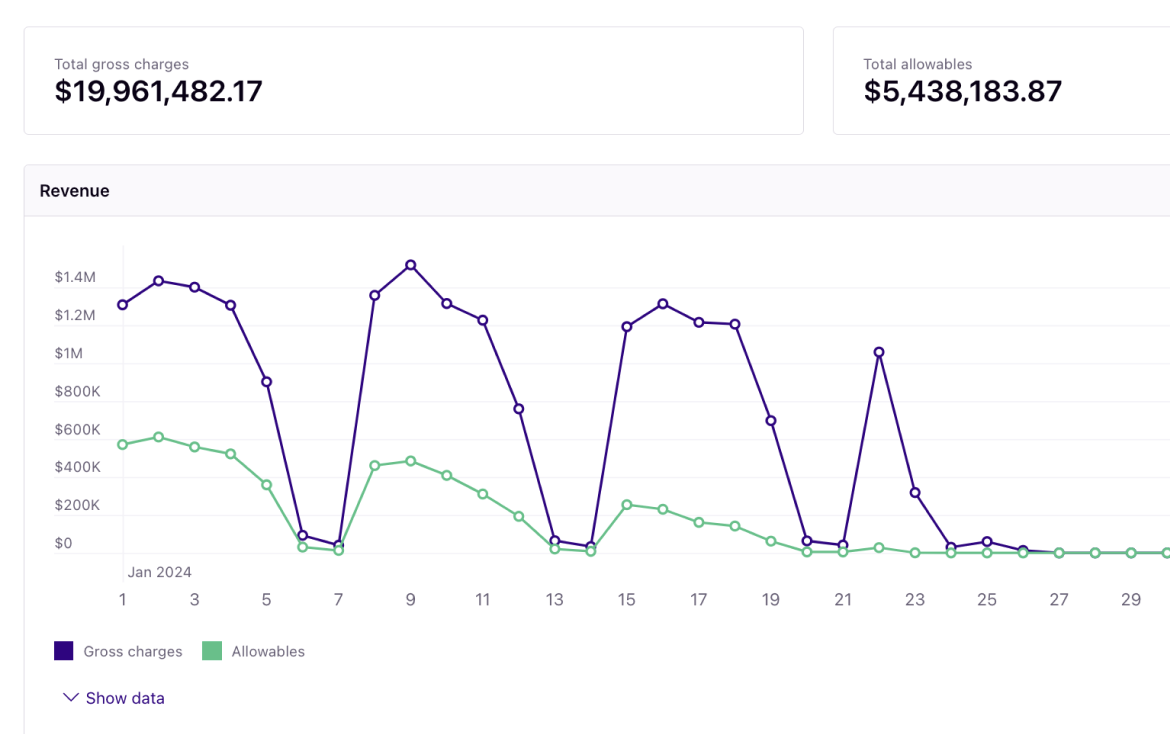

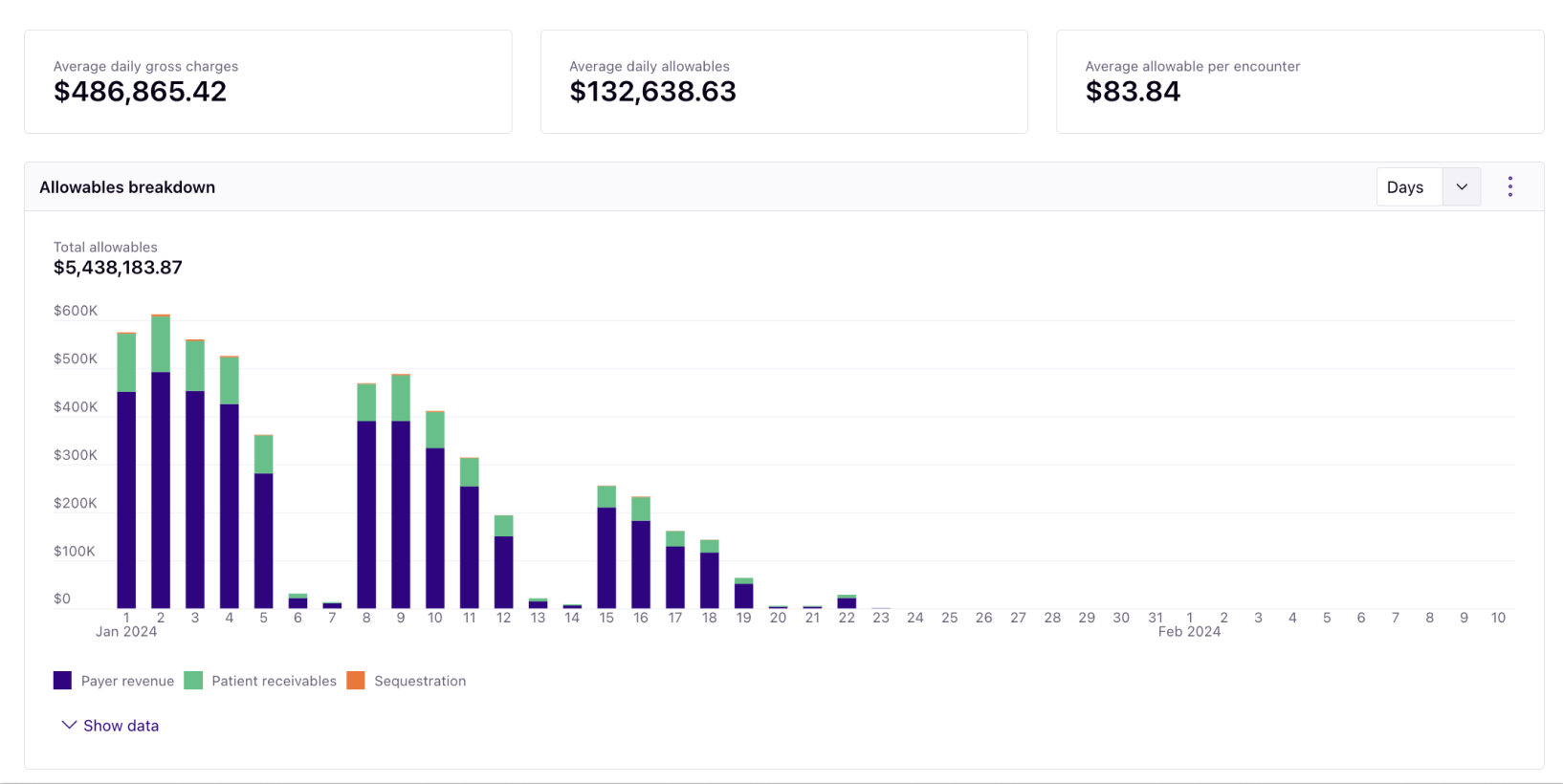

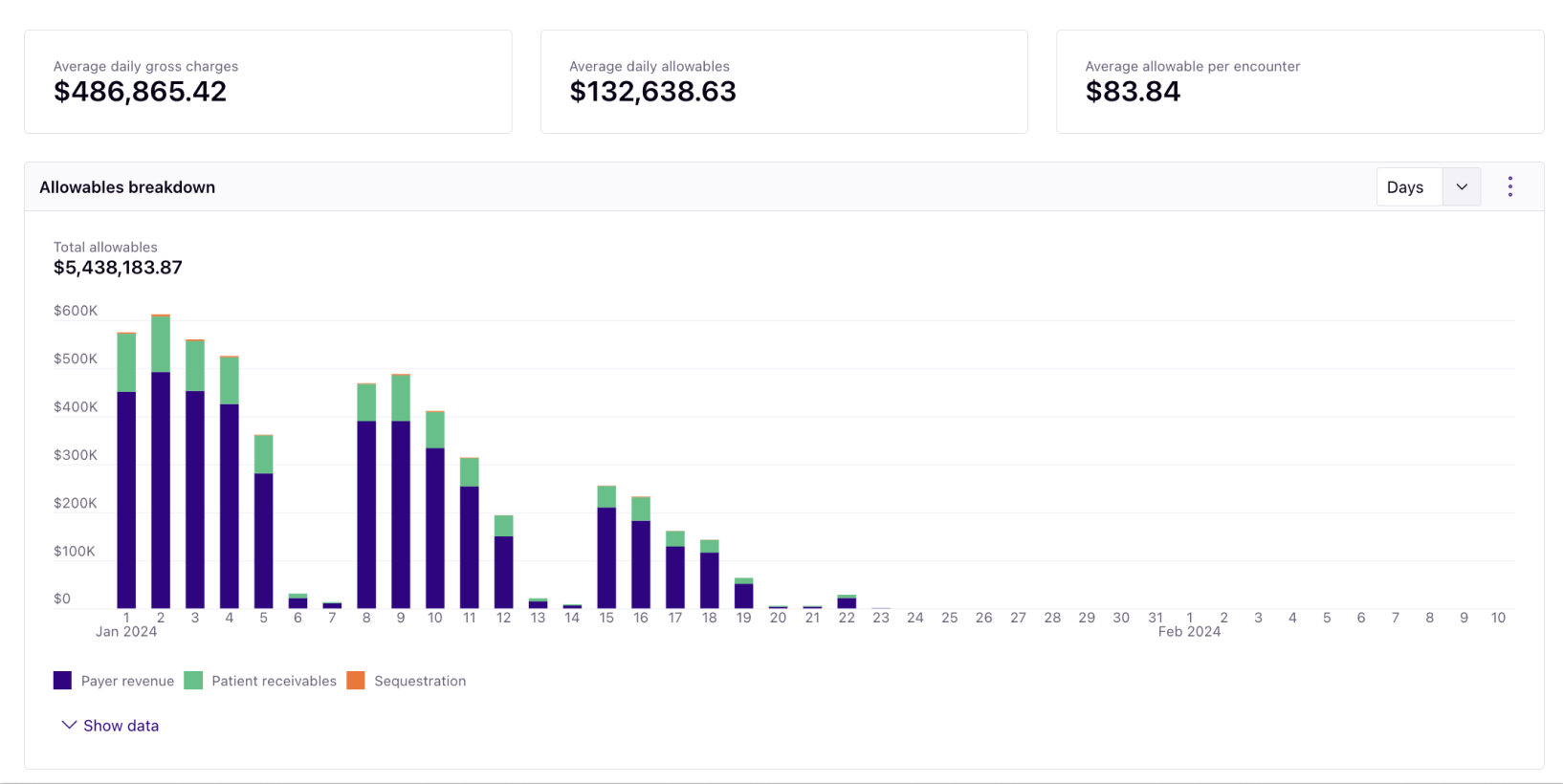

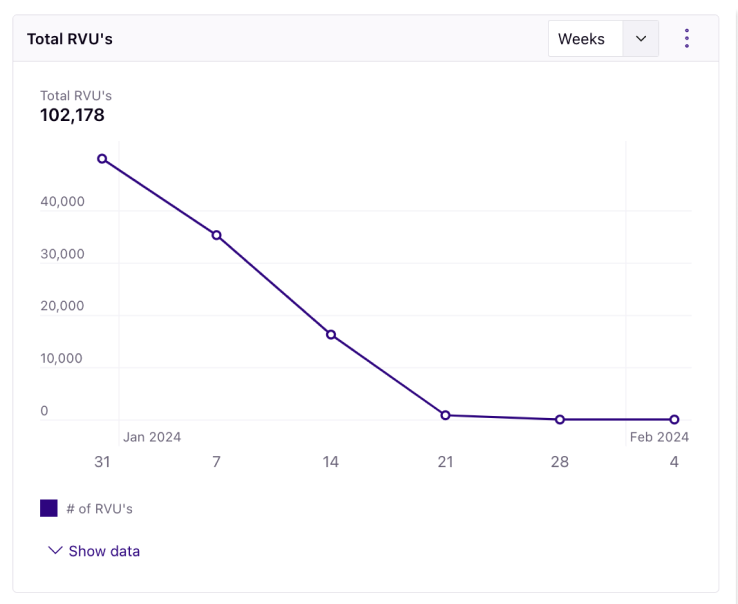

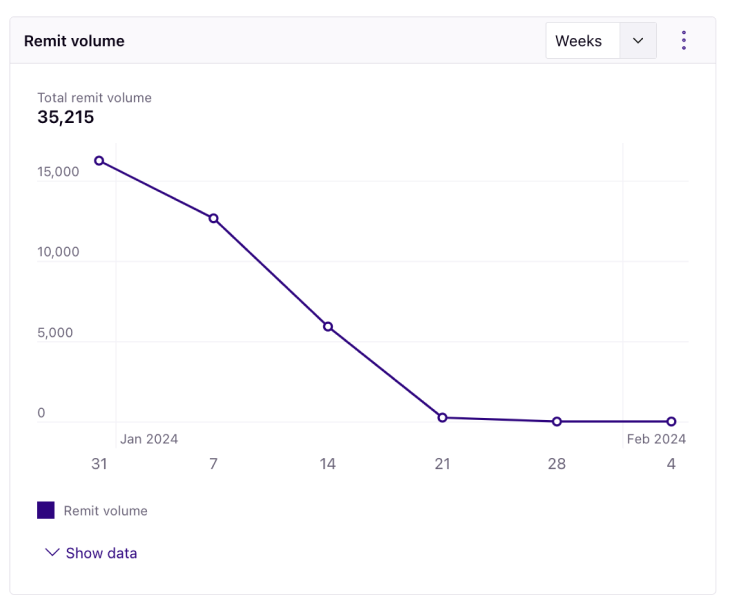

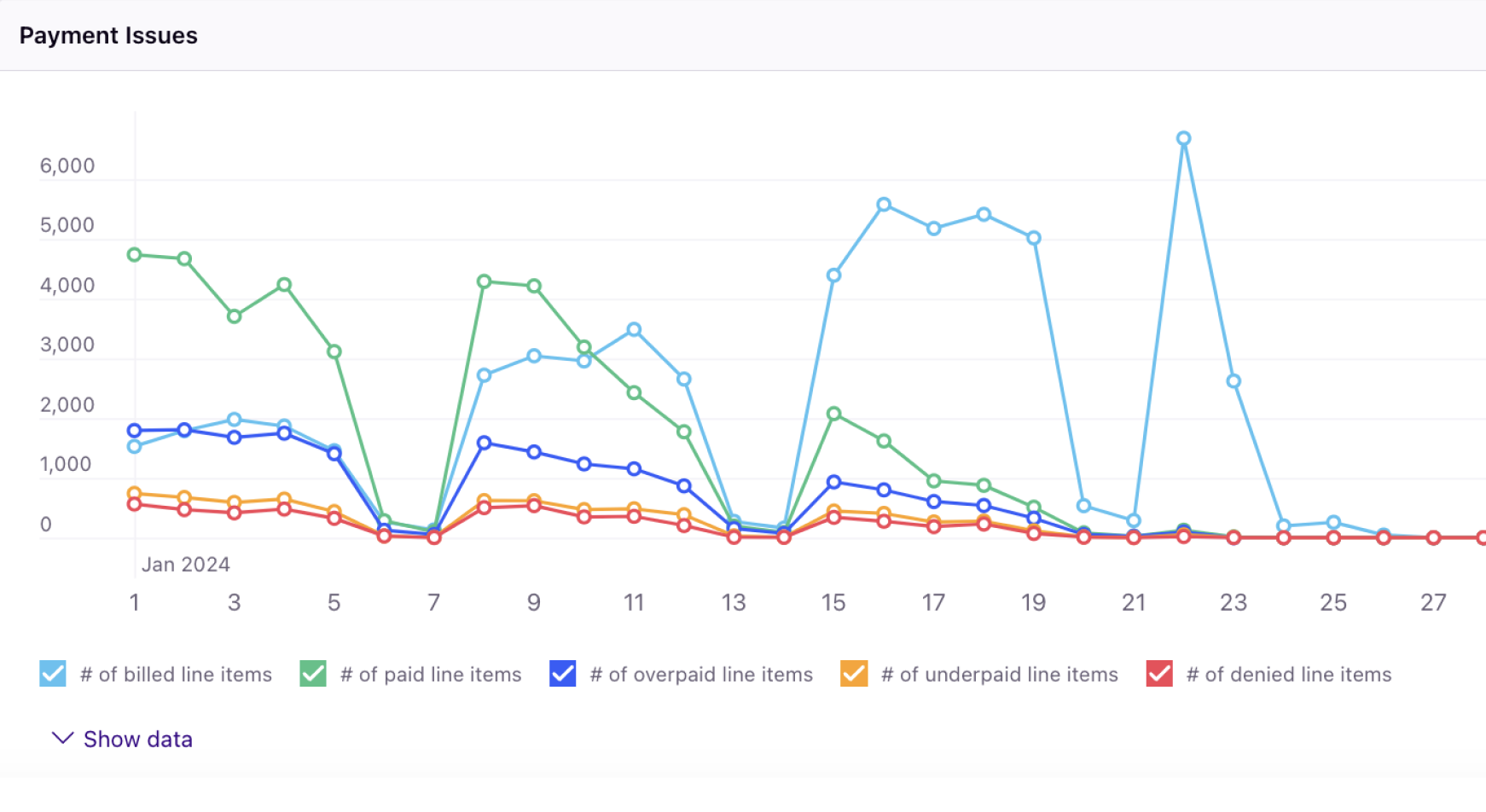

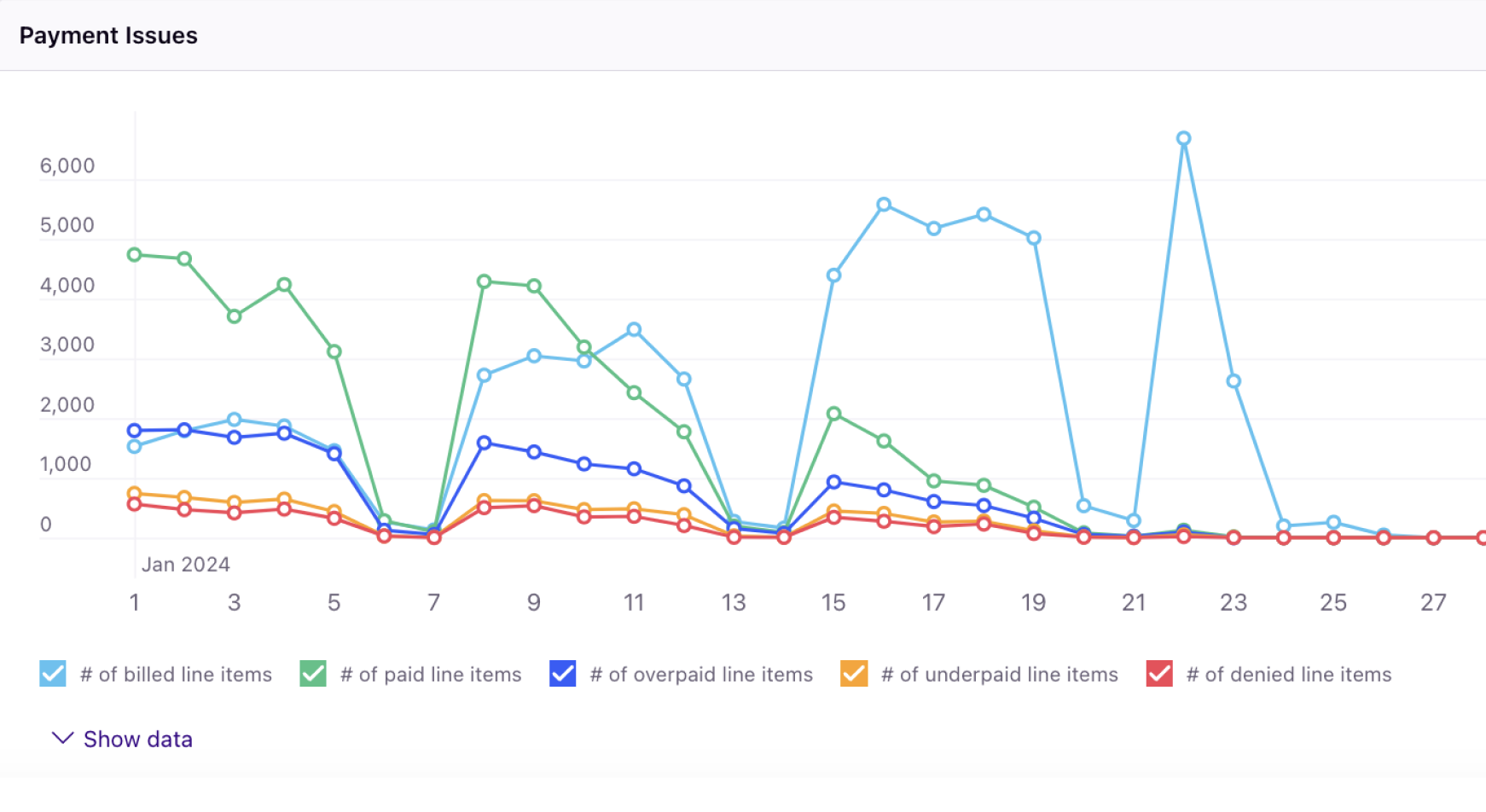

The Rivet Revenue Report allows you to analyze where your revenue derives from — drill down into allowables, gross charges and collection rates, payment issues, remit volumes, and recovery rates.

These overall metrics allow for the best overall reporting to the C-suite and allow for the best starting point for most, if not all, strategic initiatives to promote revenue maximization. Manage your revenue using these charts:

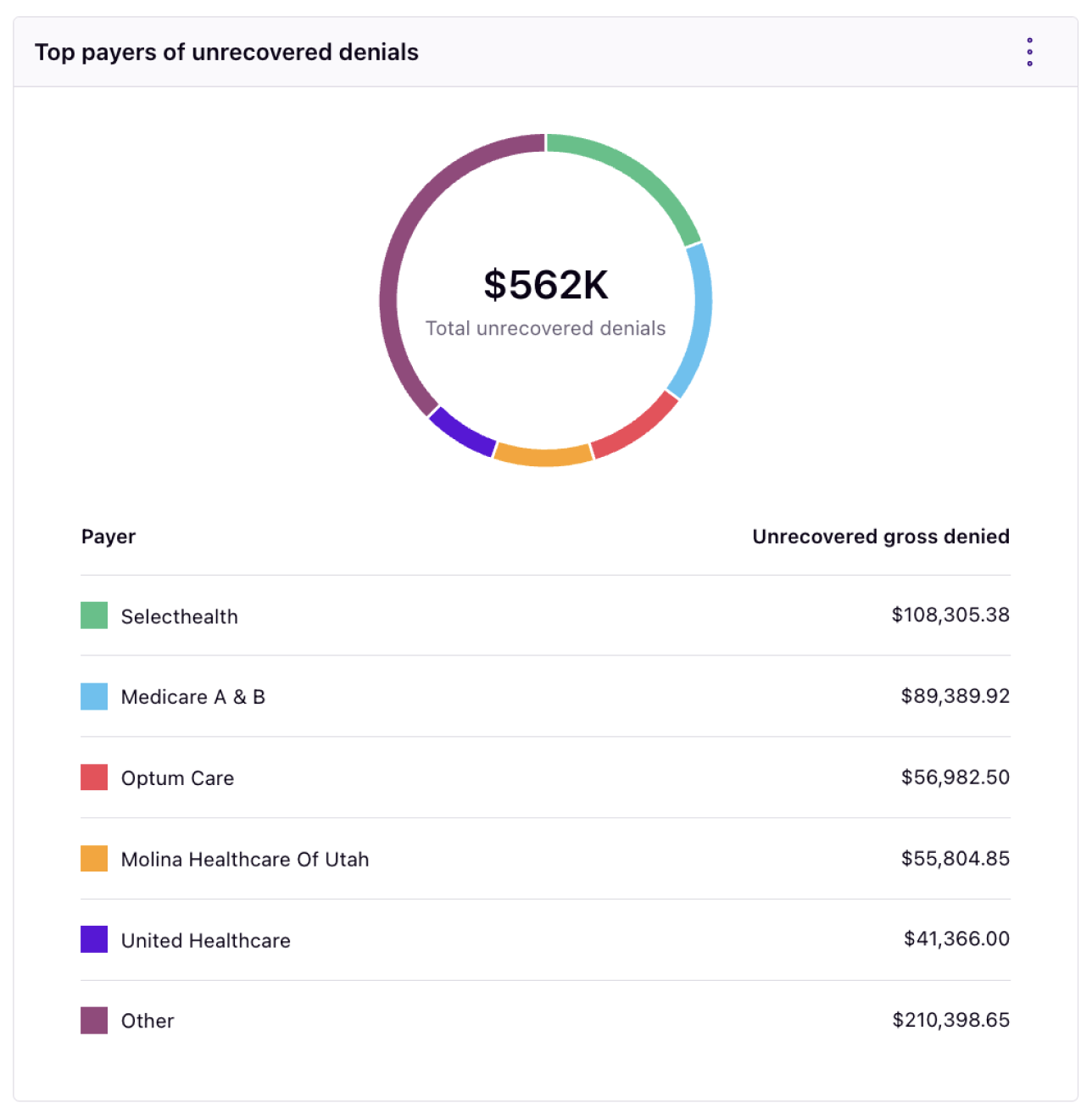

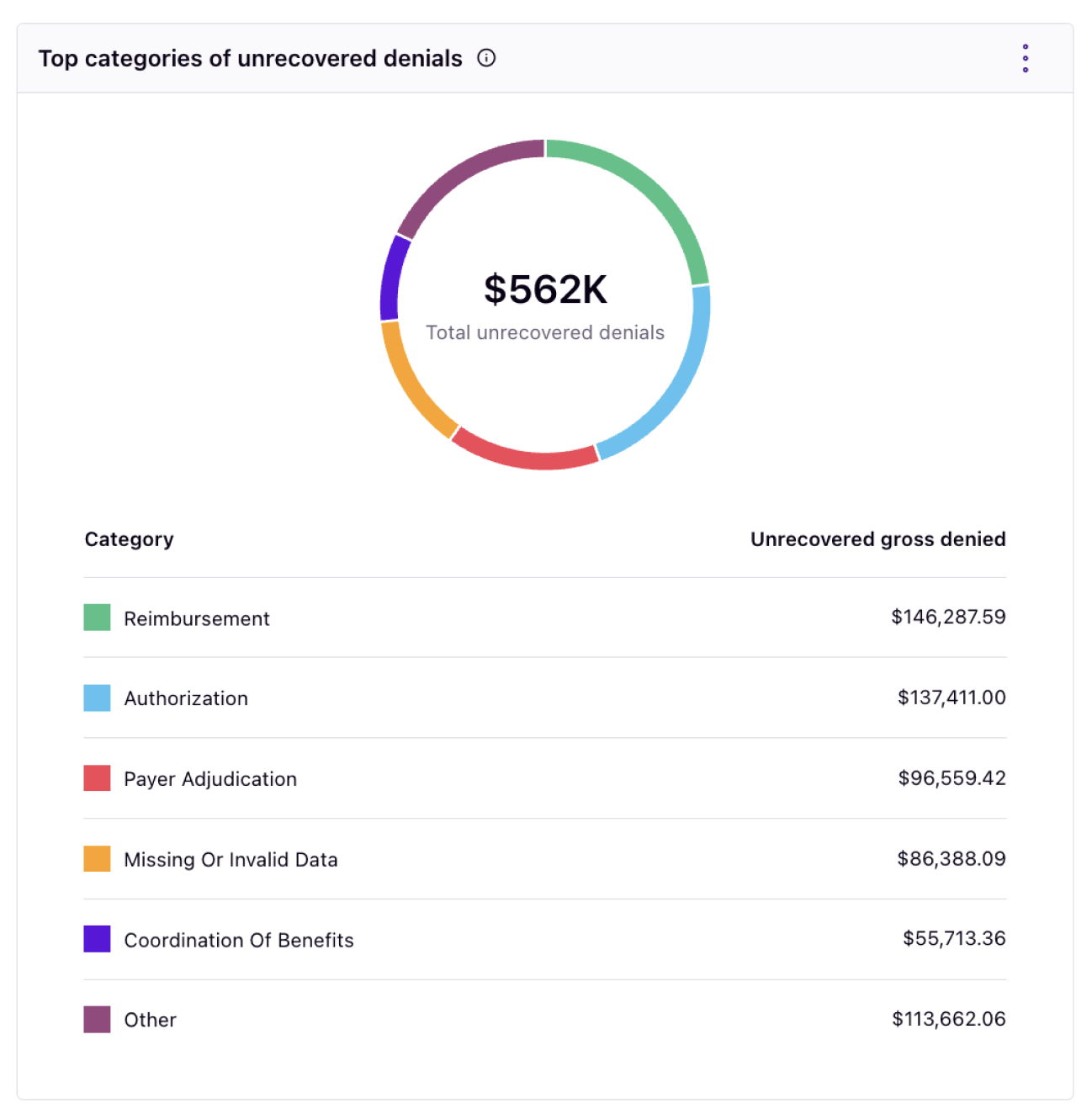

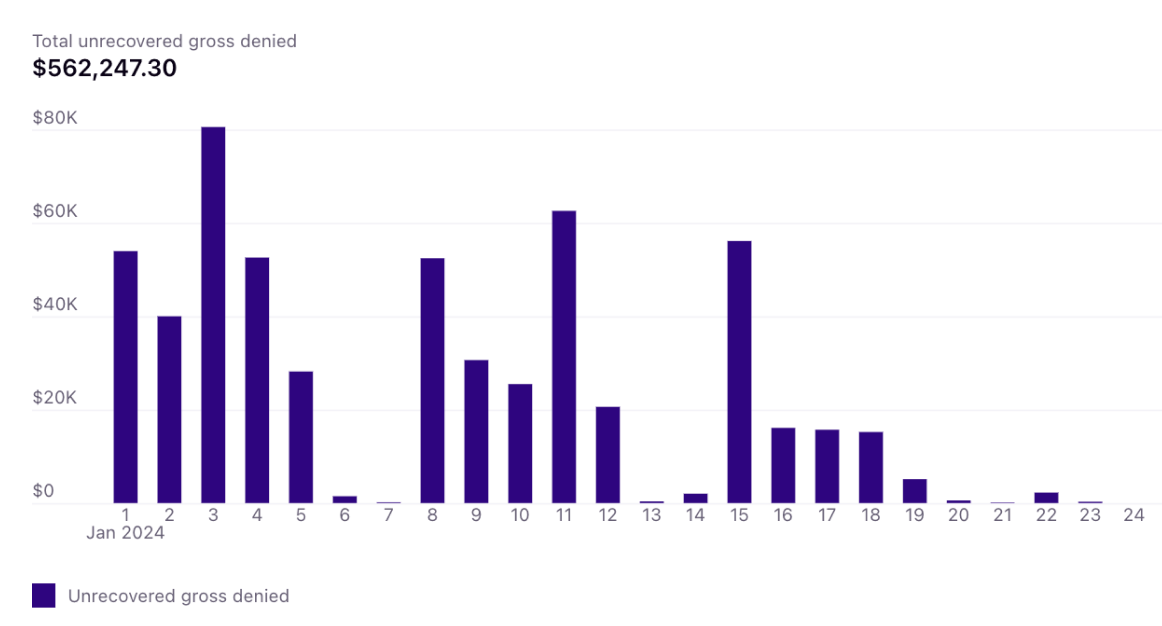

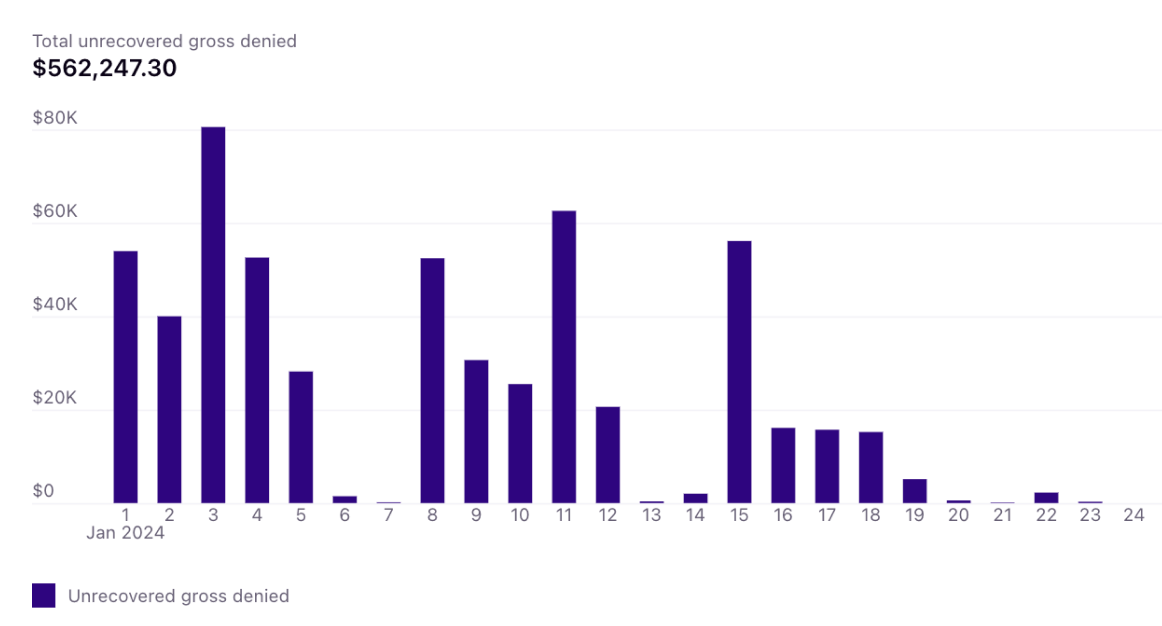

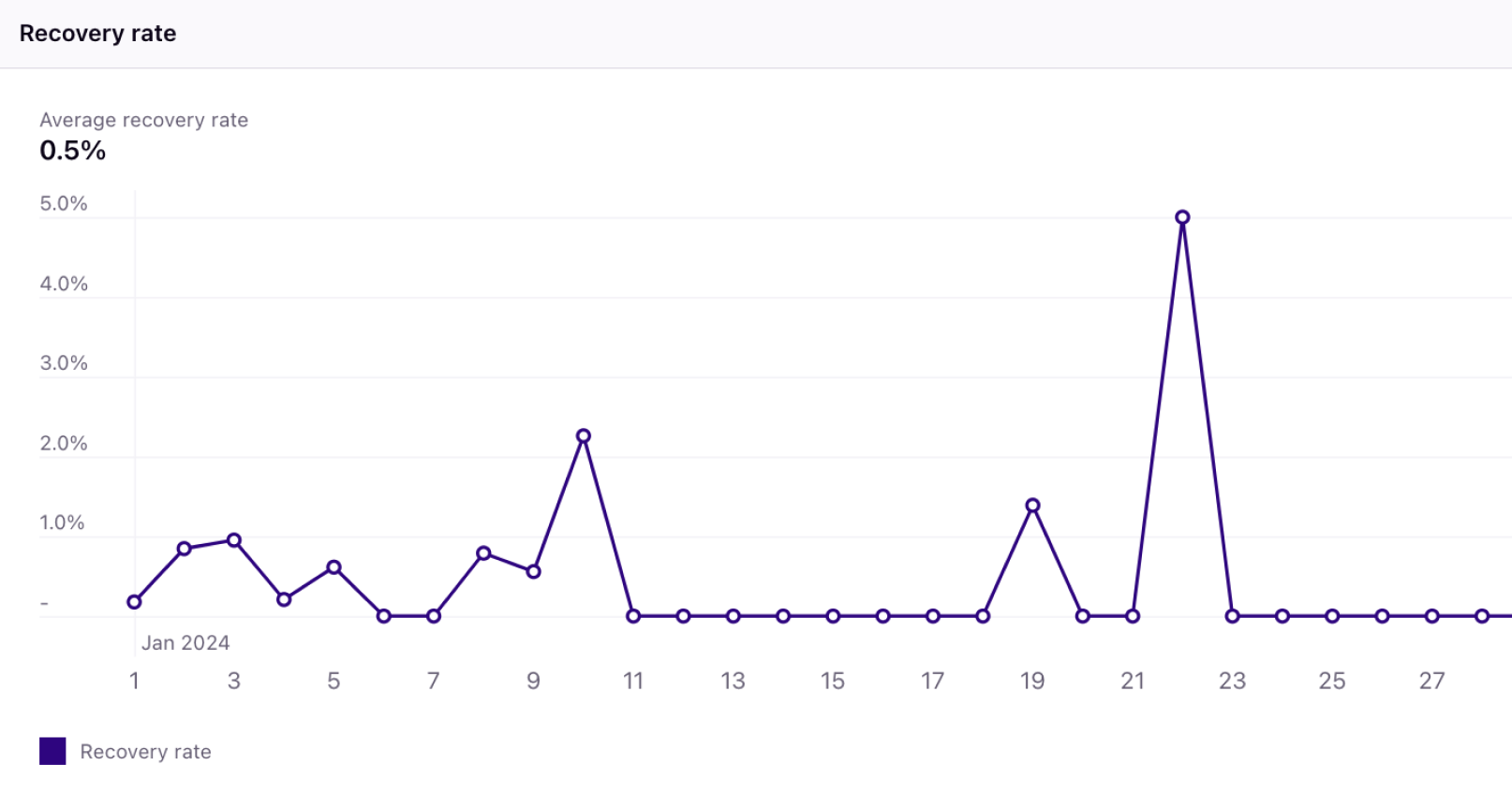

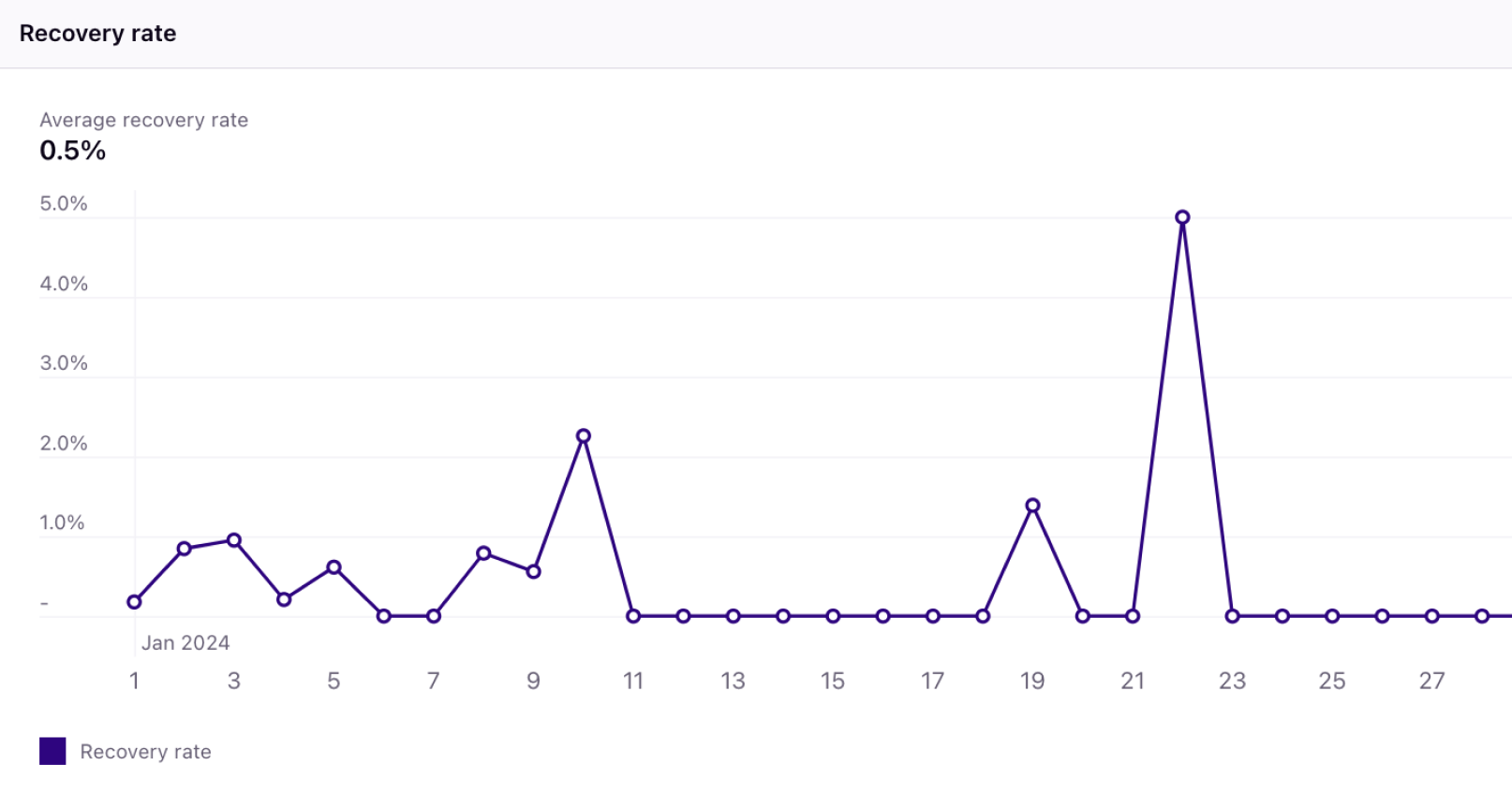

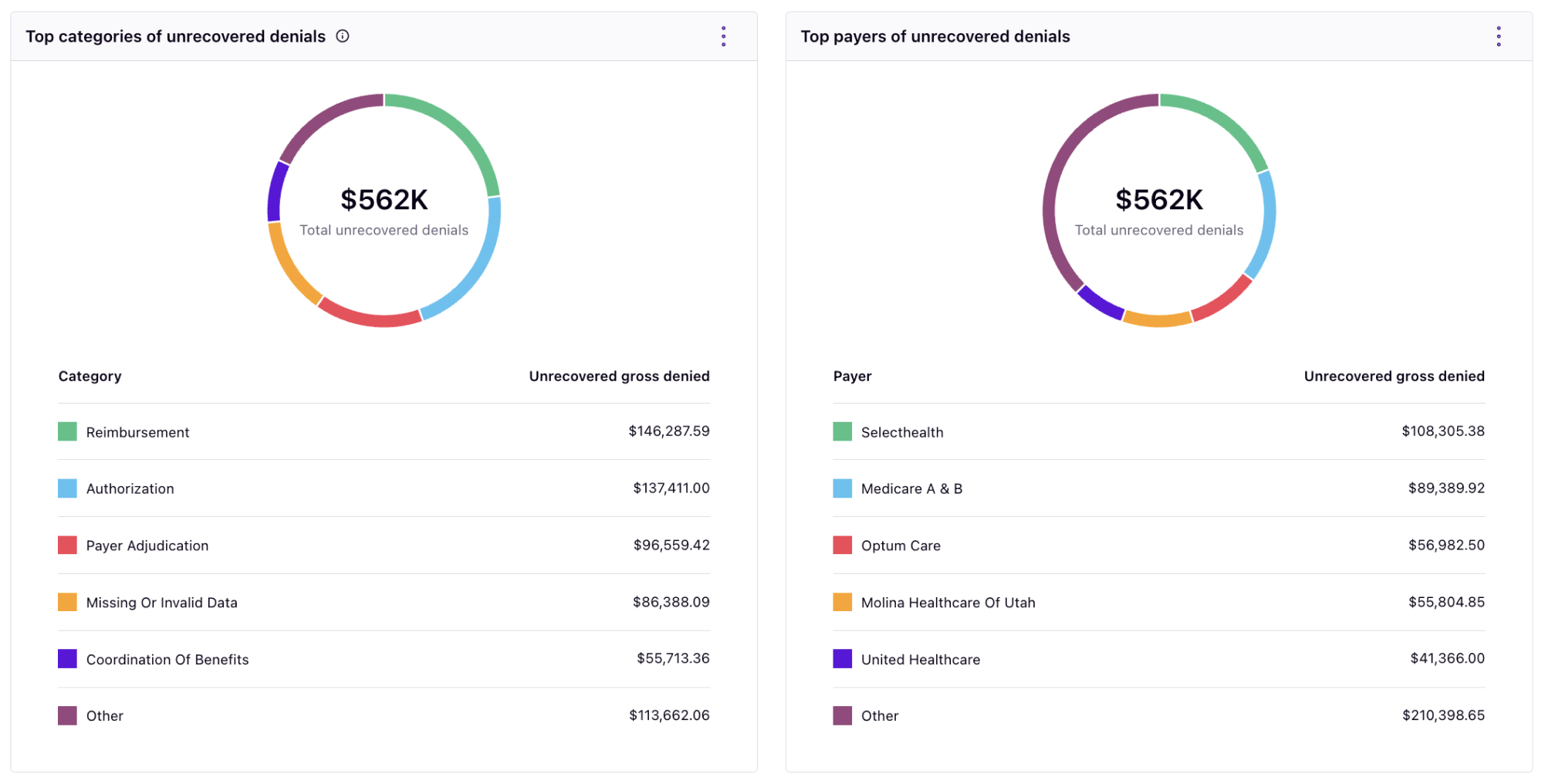

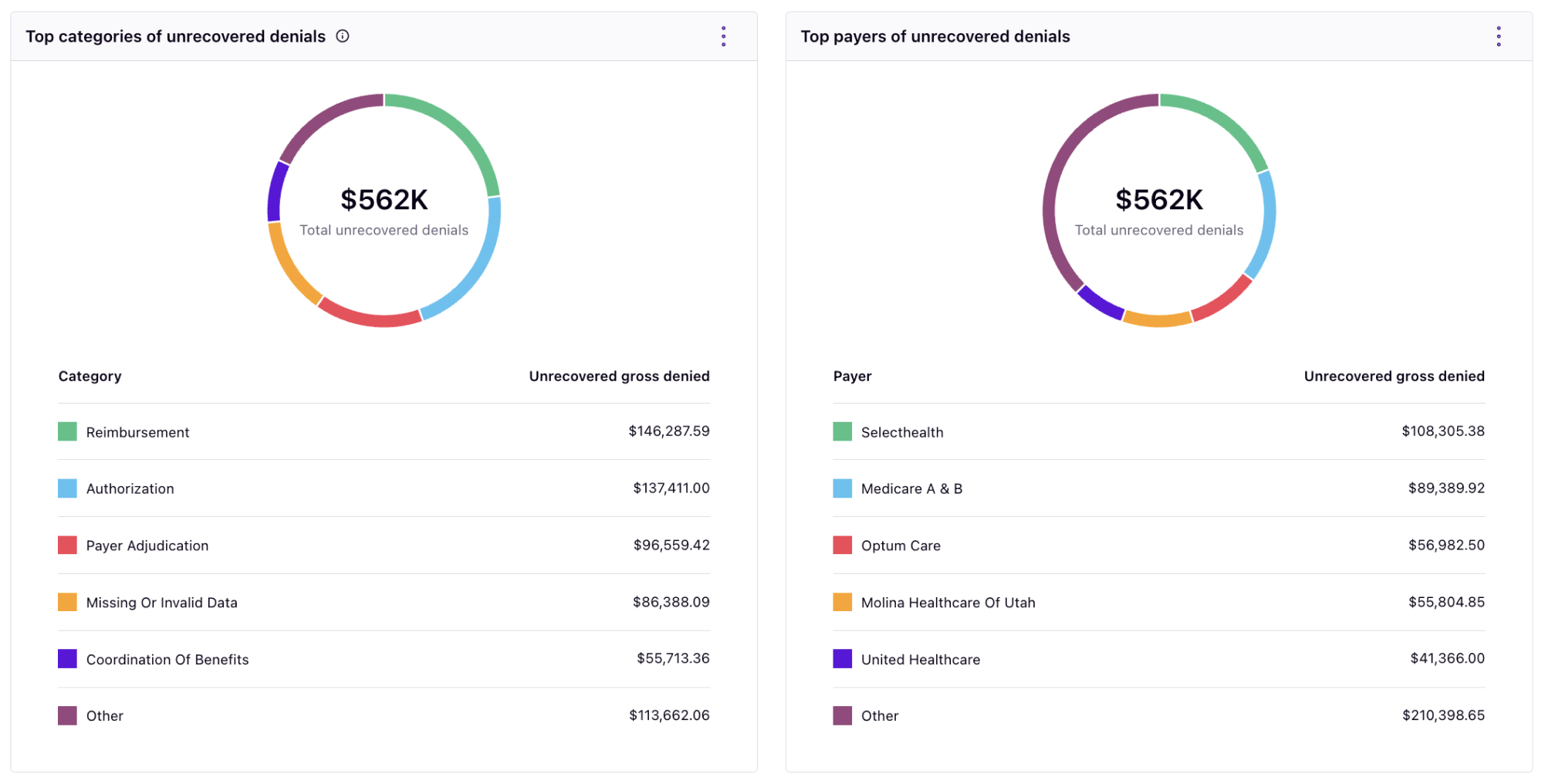

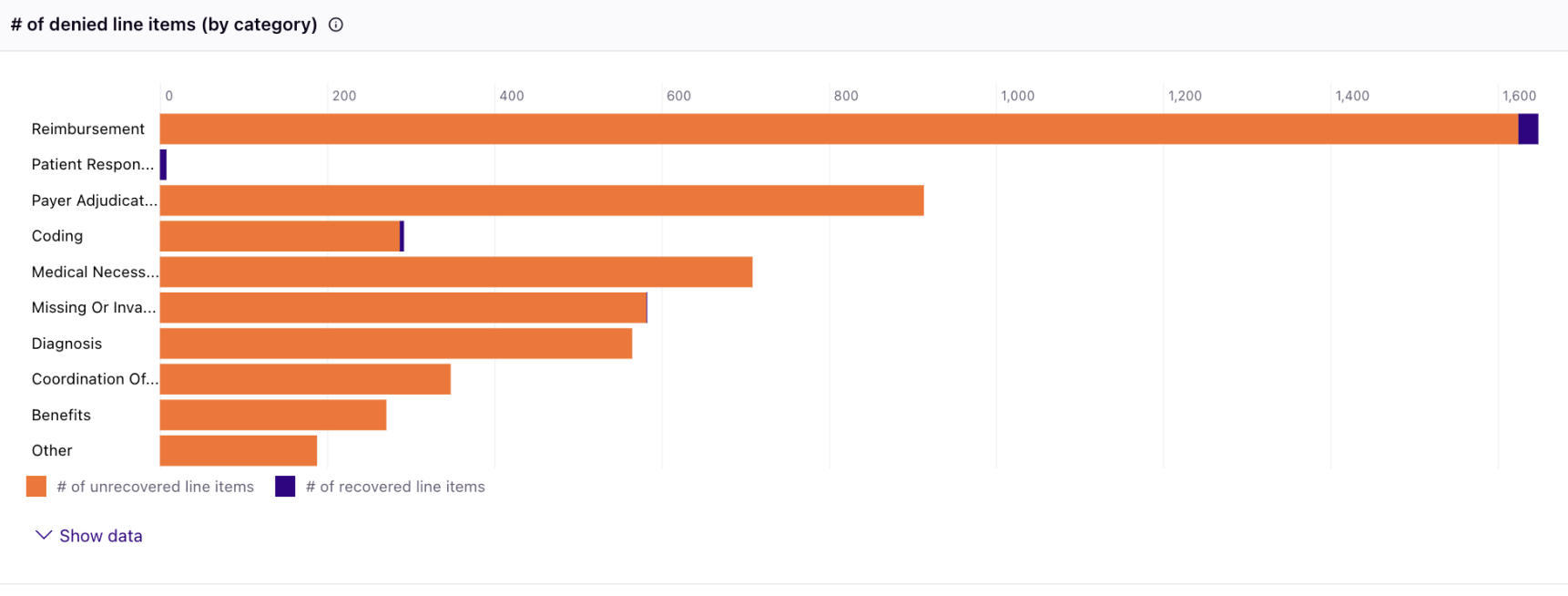

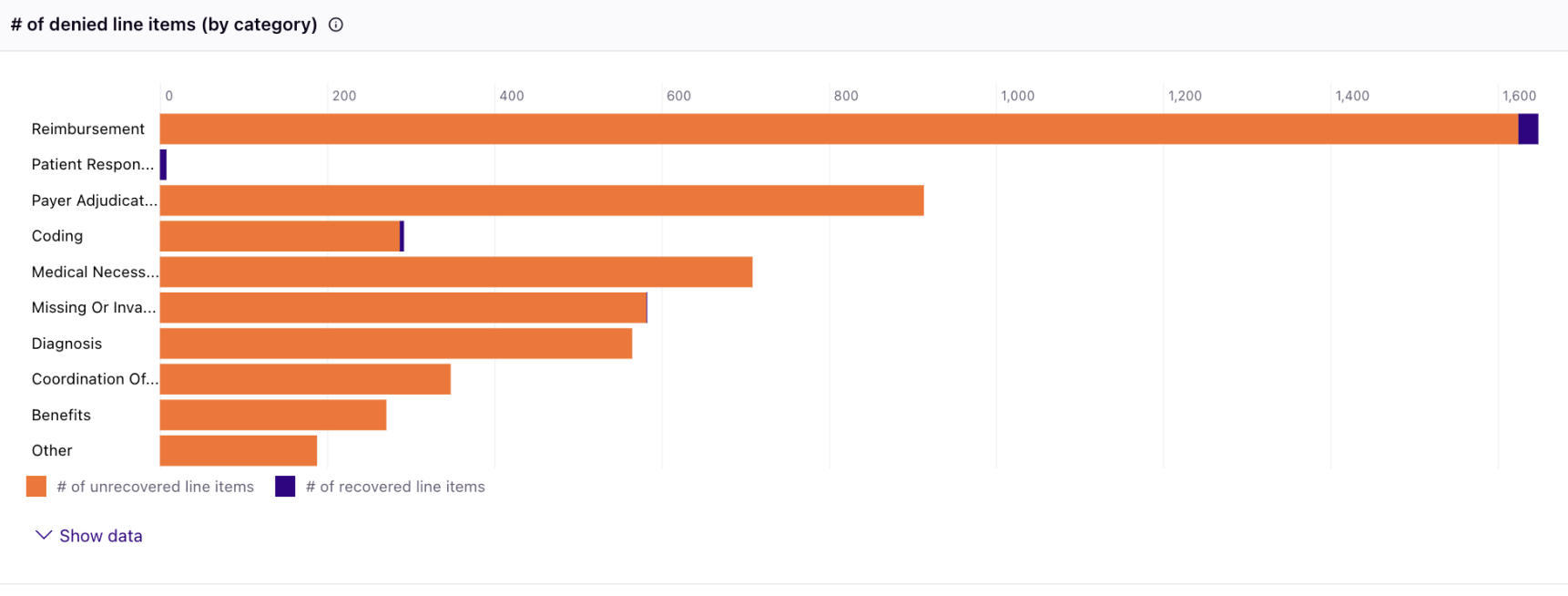

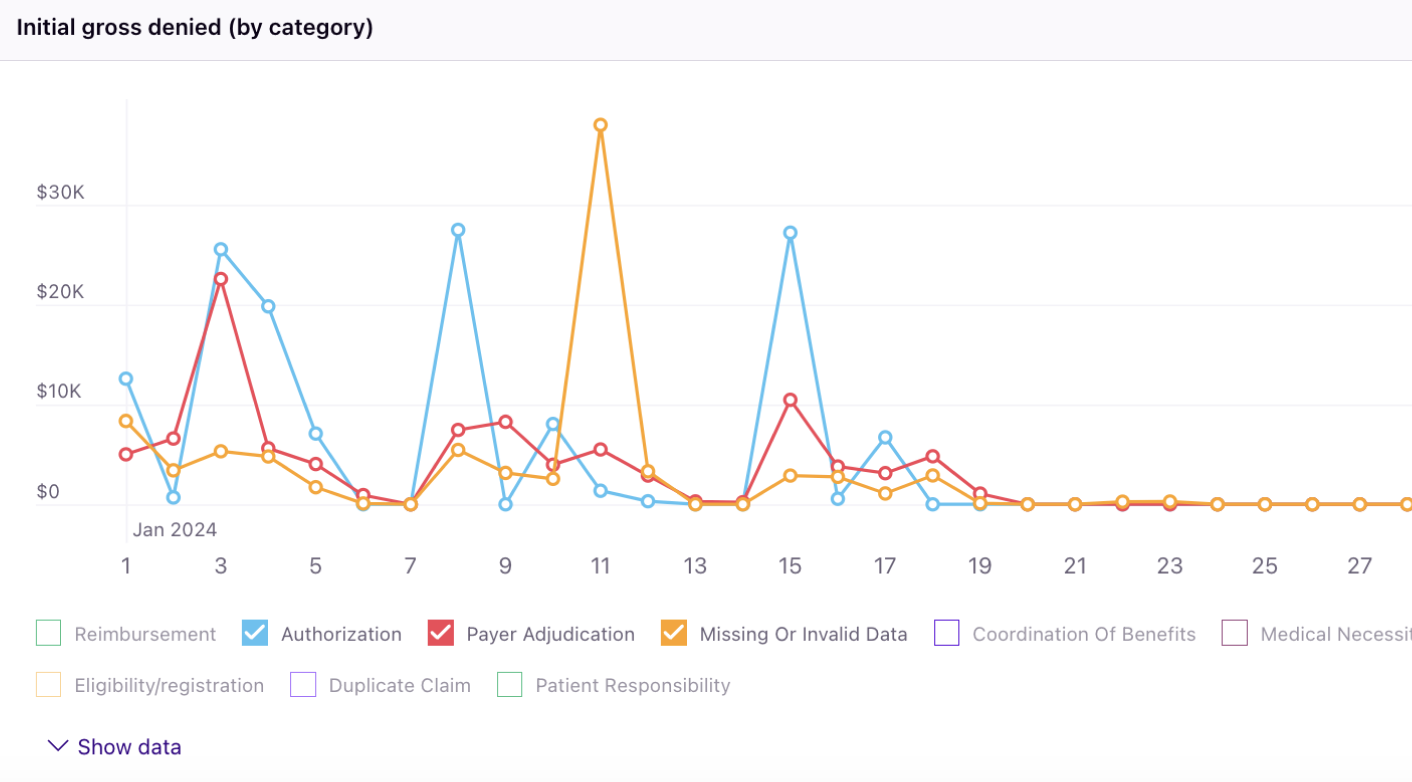

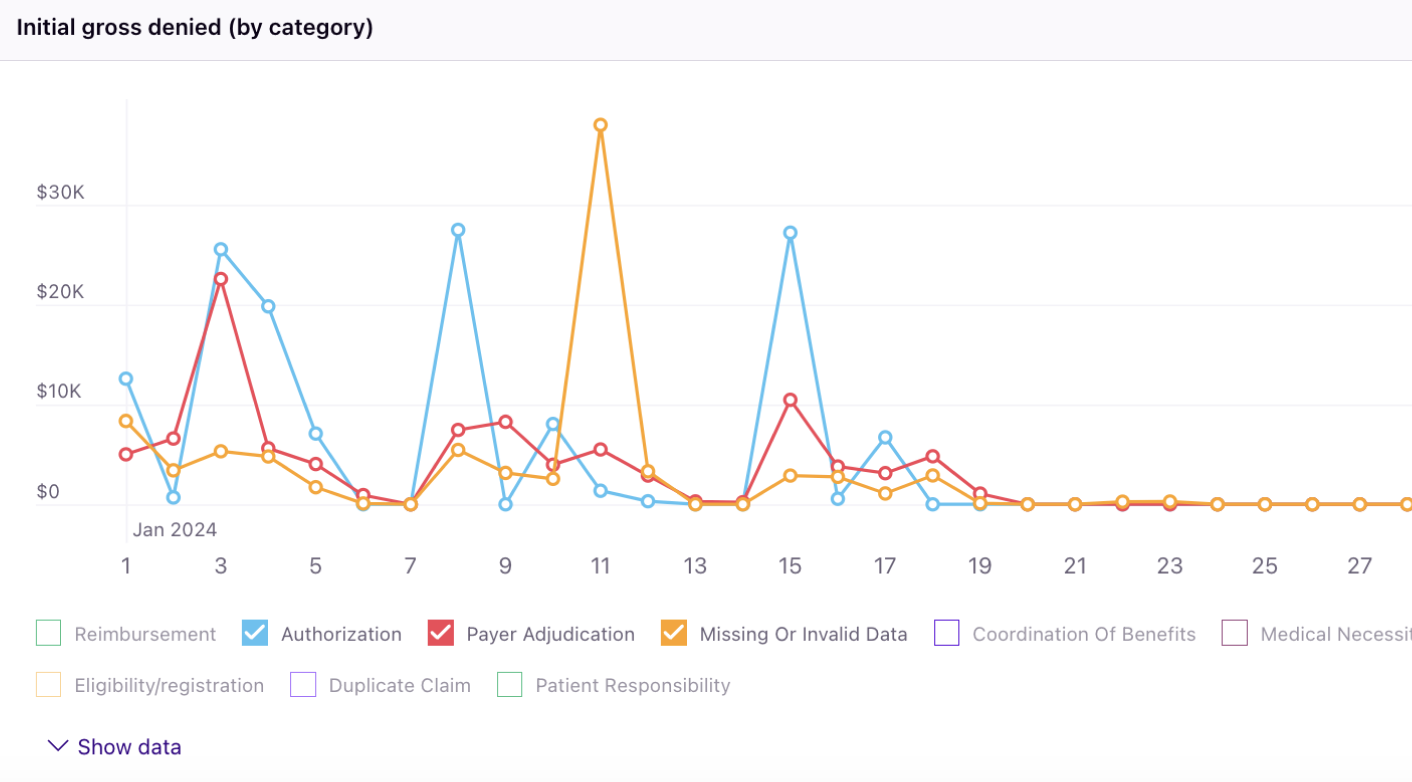

The Rivet Denial Performance Report allows you to deeply understand your initial denial rate, total initial gross denied, average recovery rate, and unrecovered gross denied charges.

Make changes in your coding, billing, and patient access teams to enhance initial clean claim rates and realize more revenue. Initiate change in your denials workflow using these charts:

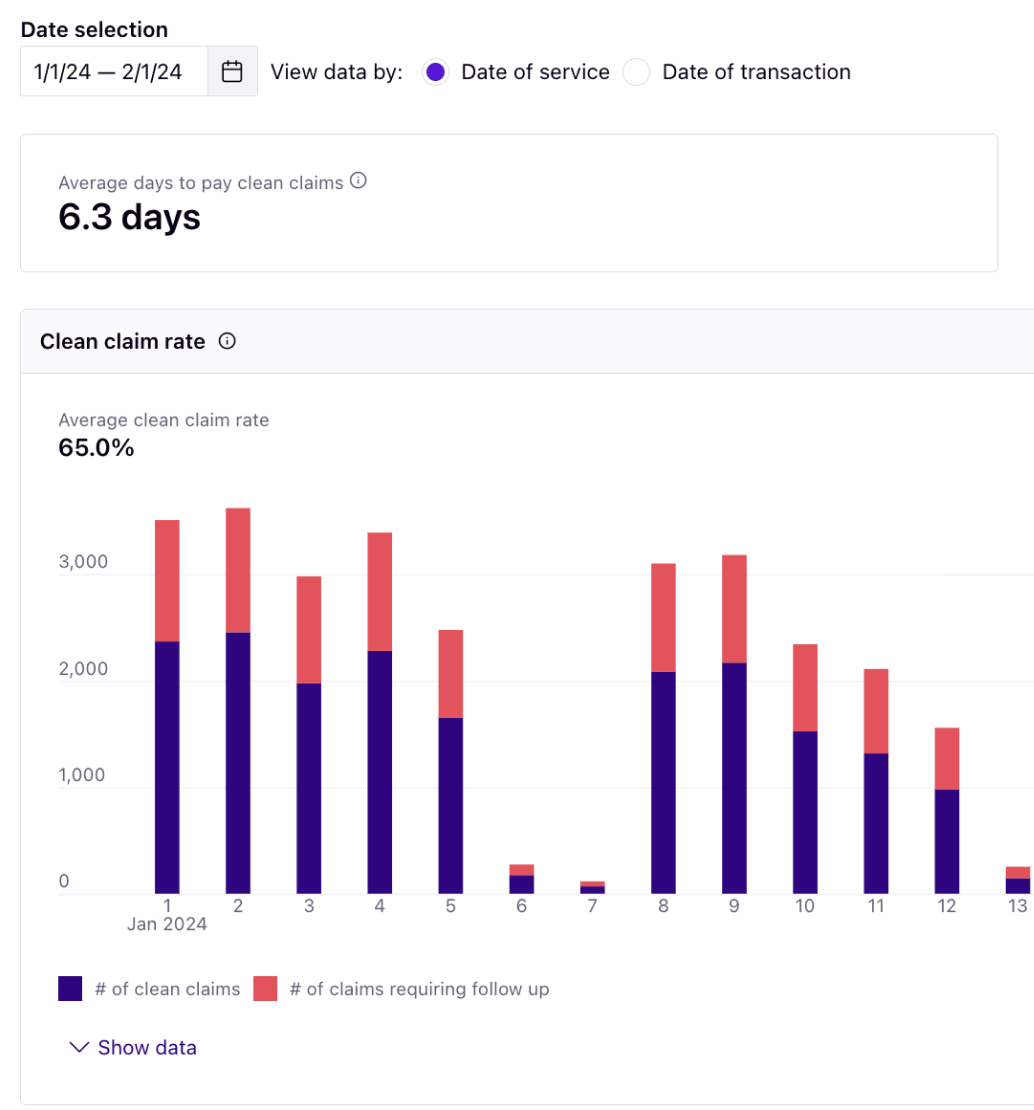

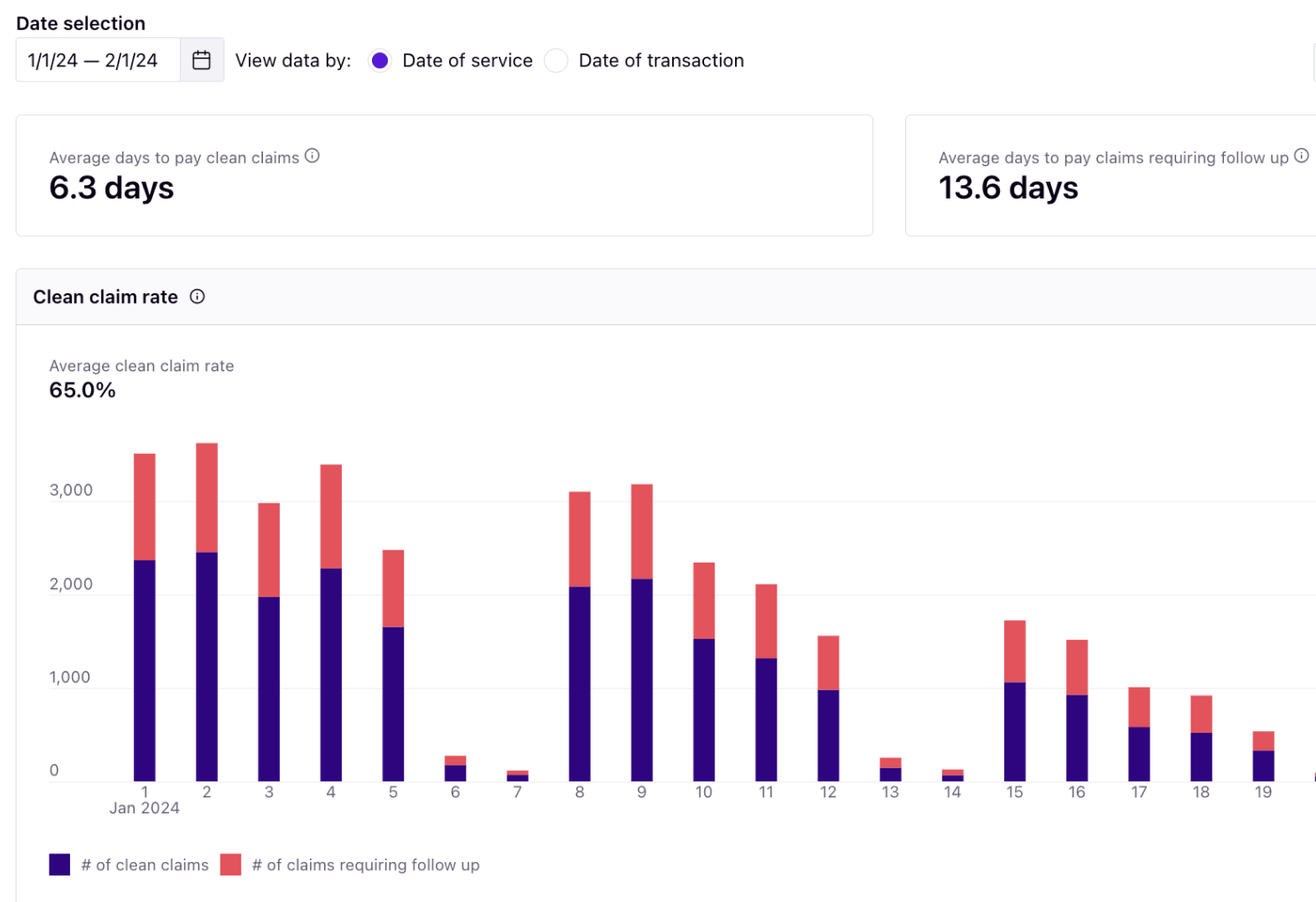

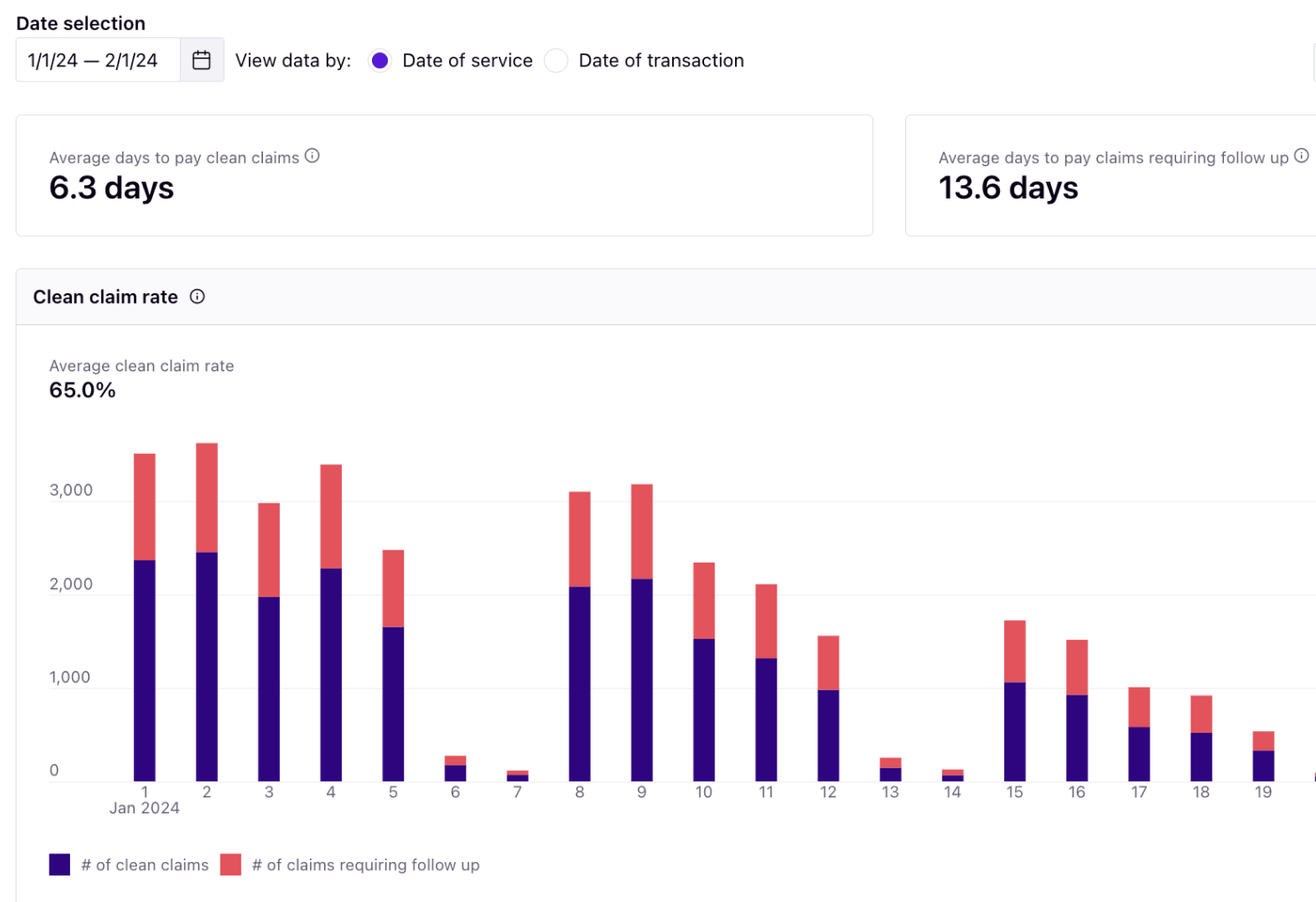

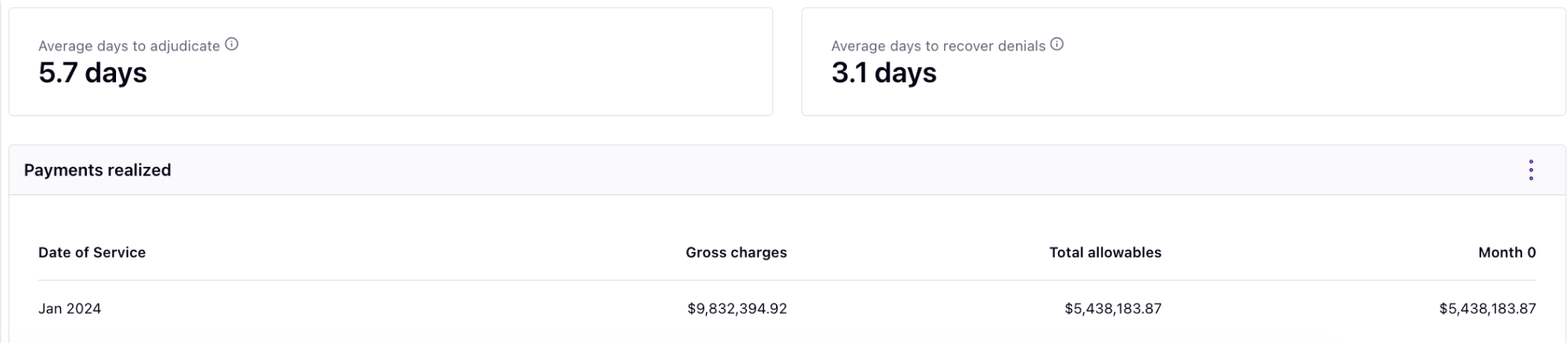

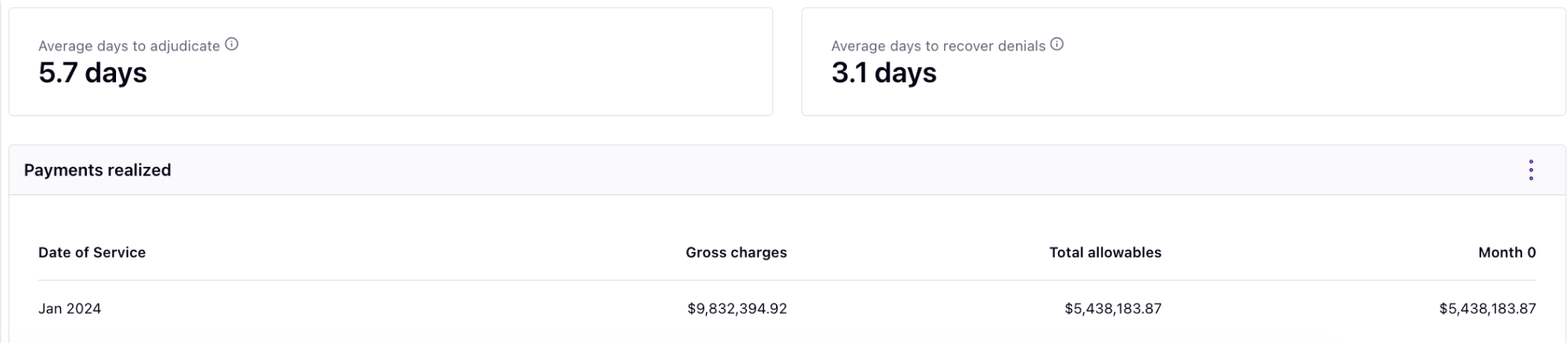

The Rivet A/R Performance Report allows you to constantly review your clean claim rate and average days to pay claims, adjudicate claims, and recover denials.

Use this data to enhance training efforts and plan strategic initiatives involving prepayment, prior authorization, coding, etc. Enhance strategic initiatives using these charts:

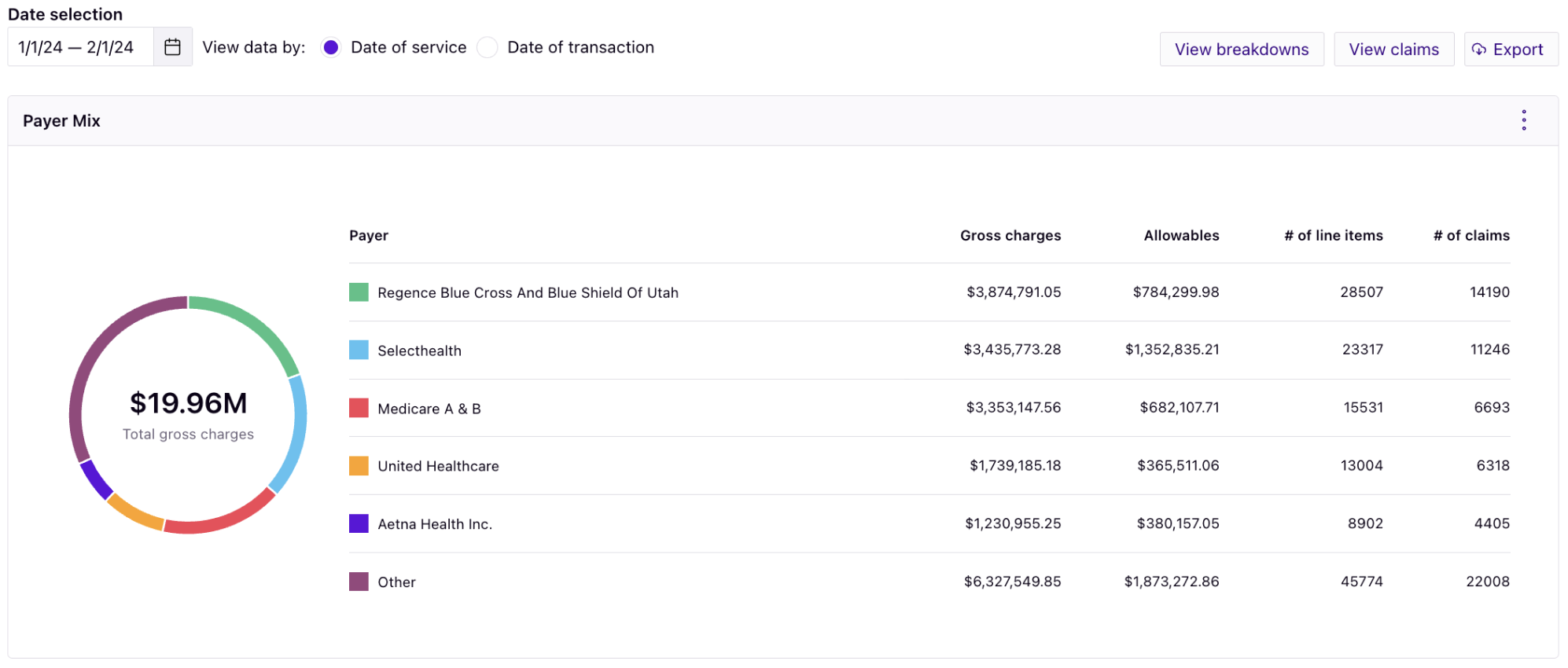

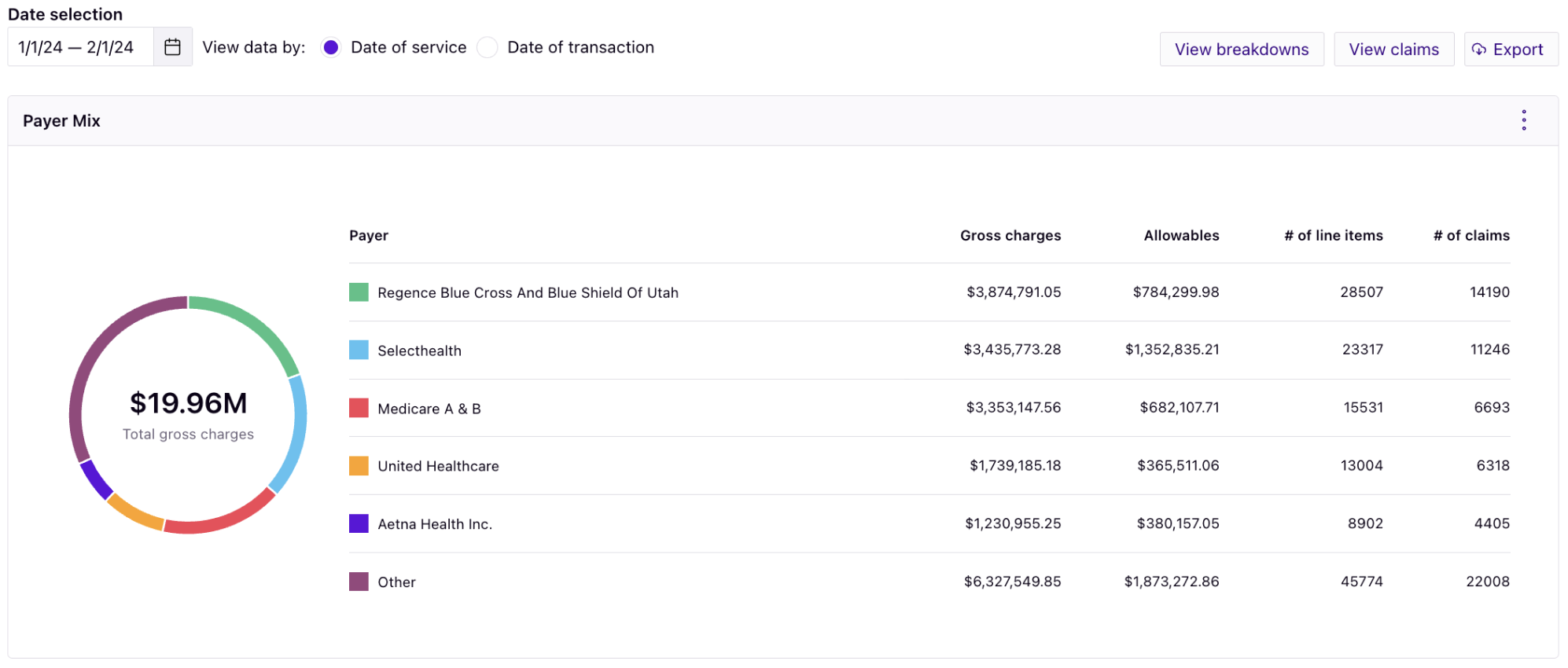

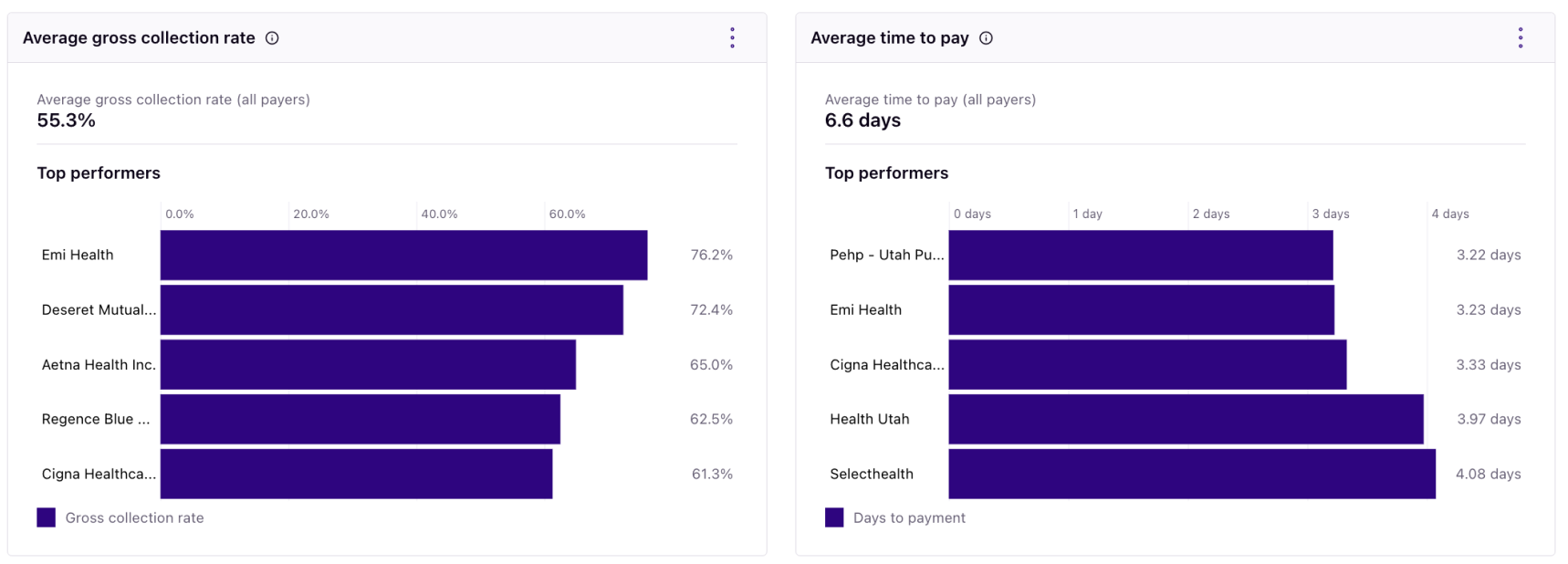

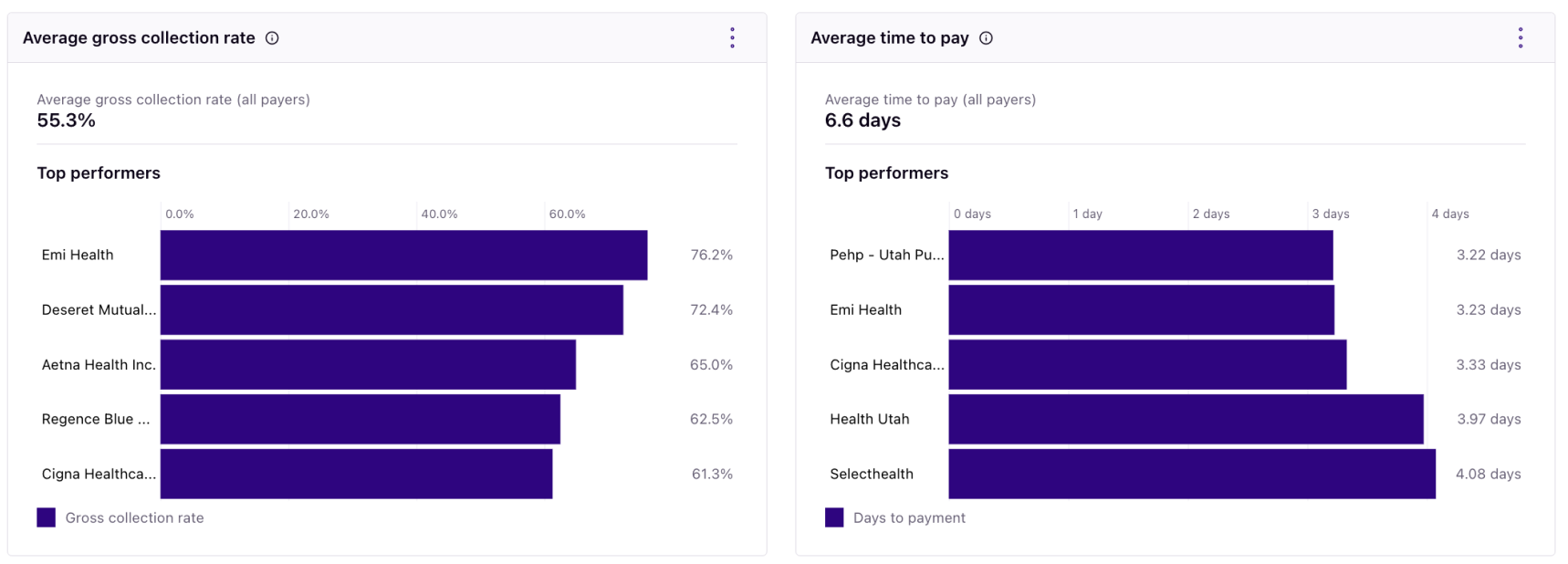

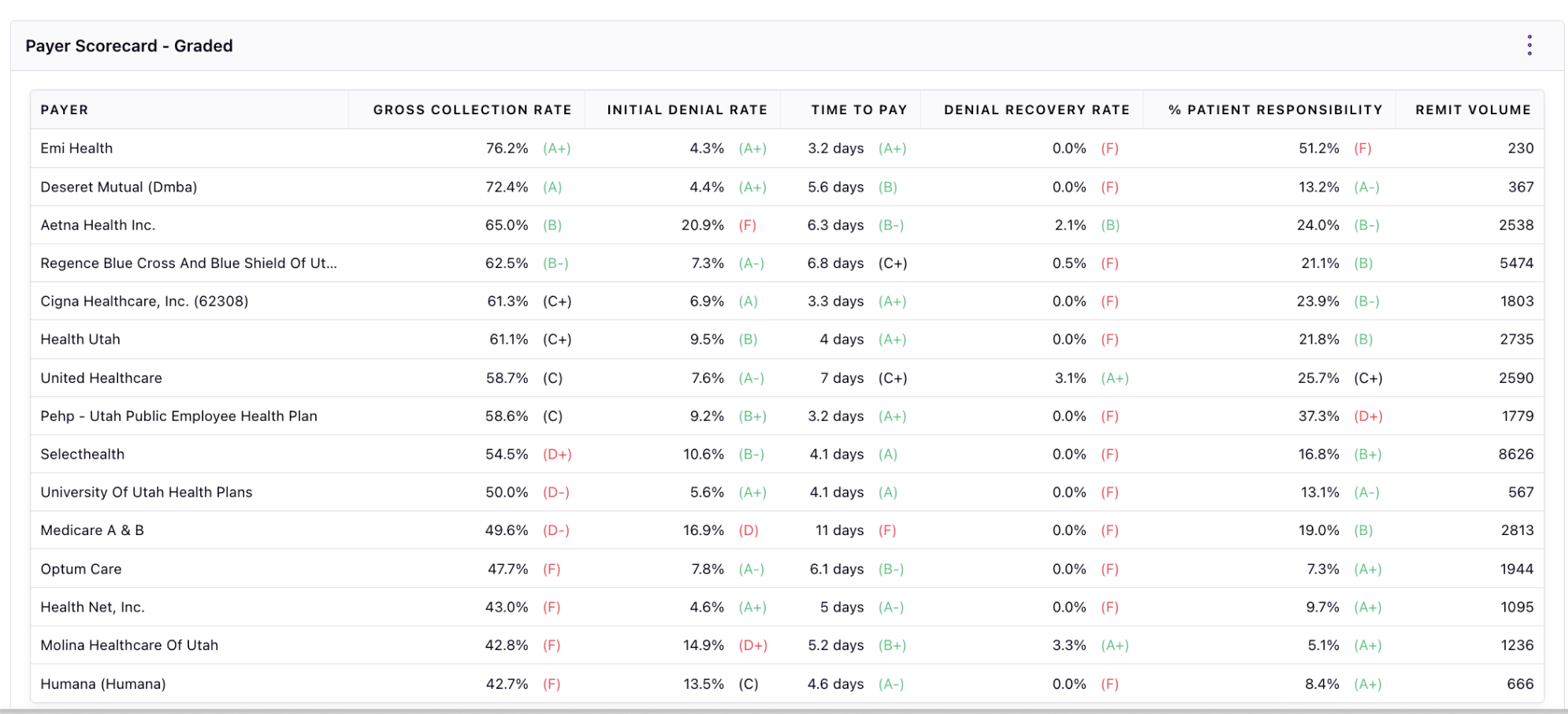

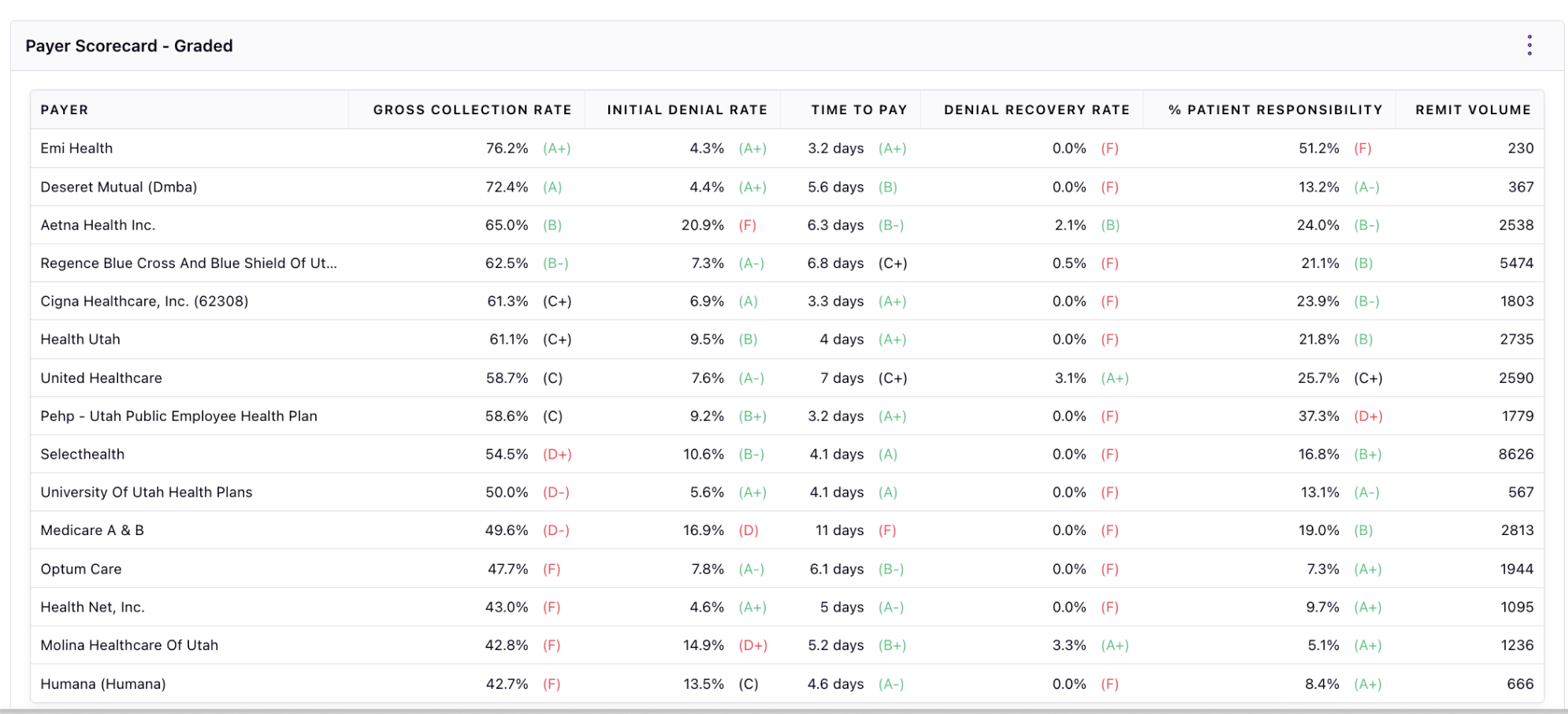

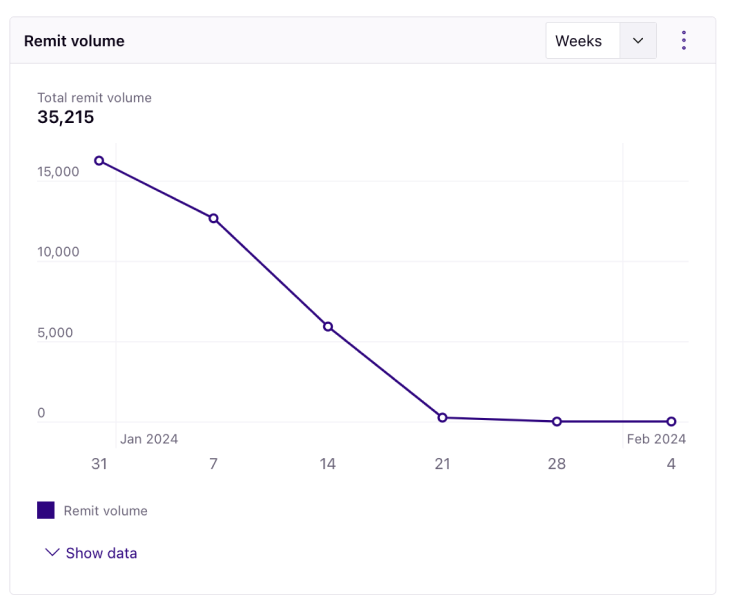

The Rivet Payers Report allows you to discover your payer mix, average gross collection rate by payer, average time to pay by payer, and how your payers compare to each other.

Jump into this data for ongoing metrics involving all of your insurance payers to prepare for contract negotiations. Manage your payer metrics for contract negotiations using these charts: