As we start 2022, let's look back at the best updates we've seen at Rivet, yet! It's been a big year: we launched Denials Management and claims analytics tools, added significant changes to our Estimates product and so much more.

Top 2021 Updates

Use Estimates to comply with the No Surprises Act

As part of the No Surprises Act (effective 1/1/2022), federal regulations now require health care providers (including ASCs) to provide a good faith estimate to uninsured/self-pay patients.

Rivet Estimates can help you meet this federal requirement and stay in compliance. Click on the image below to learn more:

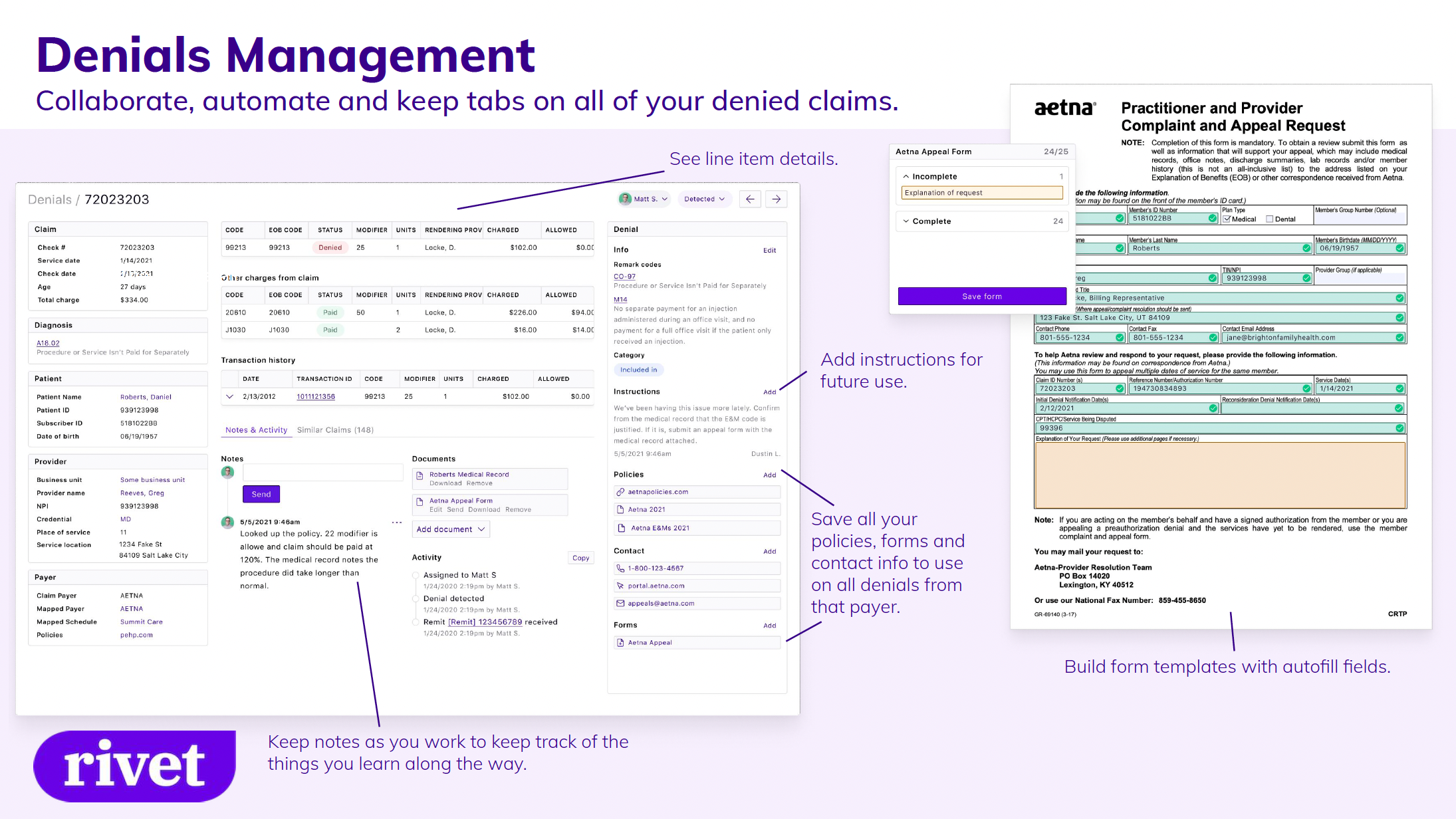

Manage and rework denials with new tools

This year we launched Denials Management, a tool used to keep a live collaborative denials database, manage intelligent claims worklists, utilize automated appeal forms and stay organized with a comprehensive claim view.

Integrate with Rivet's Estimates API

Software providers (for patient registration, patient billing, EHR, PM, etc.) who want to provide patient cost estimates without the heavy lifting can now incorporate Rivet’s estimates functionality into their current product via API.

Use Rivet in your current software to automate estimates based on your appointment schedule; send estimates and payment requests in existing patient communications such as appointment reminders and more.

Dive into your claims analytics

Filter and segment your claims data to quickly identify trends and drill down to the specific claims driving them. Easily review what’s happening in your practice and where you can increase revenue.

Significant Estimates, Eligibility and Payments Updates

Offer estimates for multiple payers

Estimate patient responsibility for patients with multiple levels of coverage, taking into account what earlier payers will pay.

Offer comprehensive estimates for multiple treatments

Create a single comprehensive estimate for patients who will see multiple providers; have multiple visits; or receive care comprising facility, non-facility, and/or ASC services.

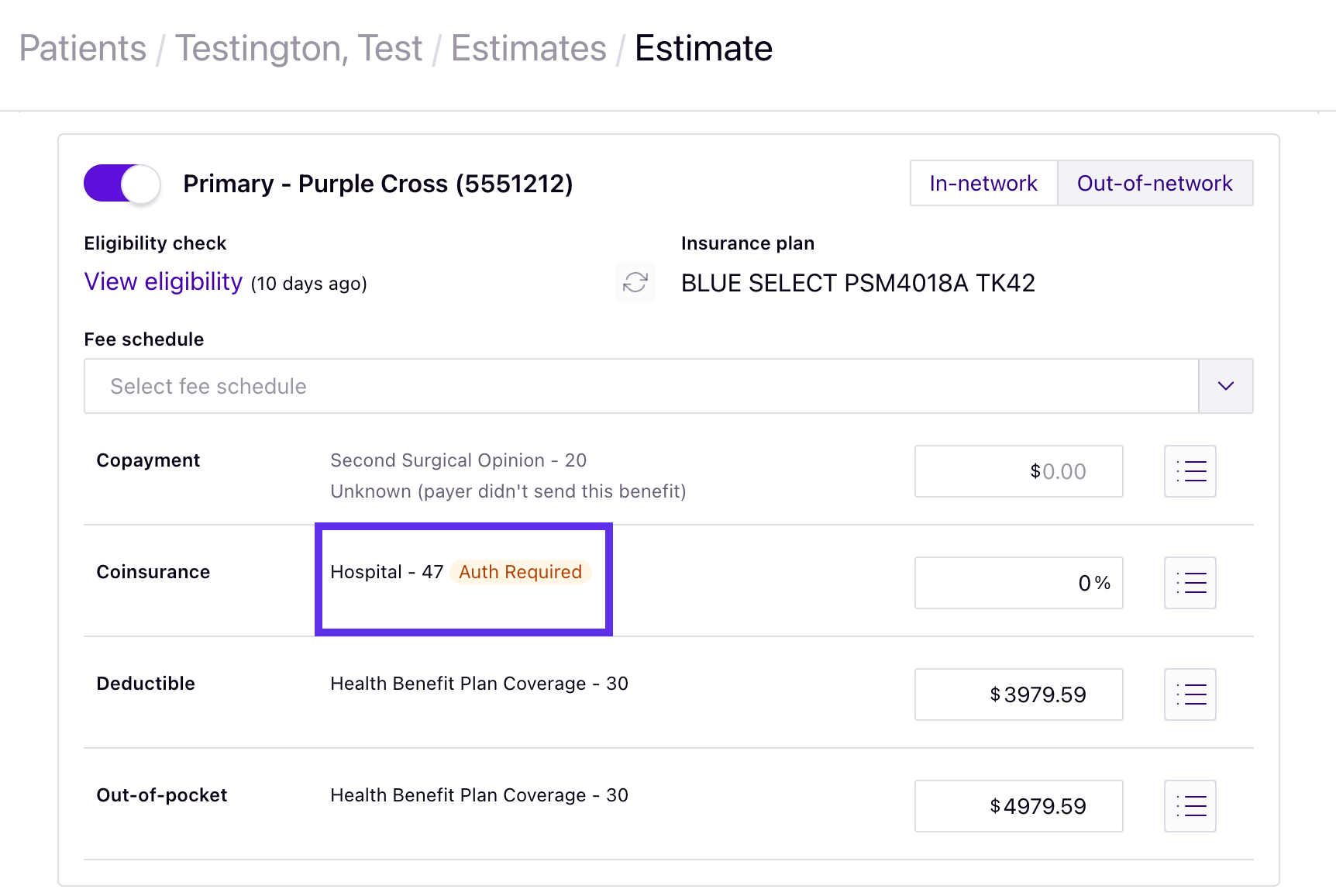

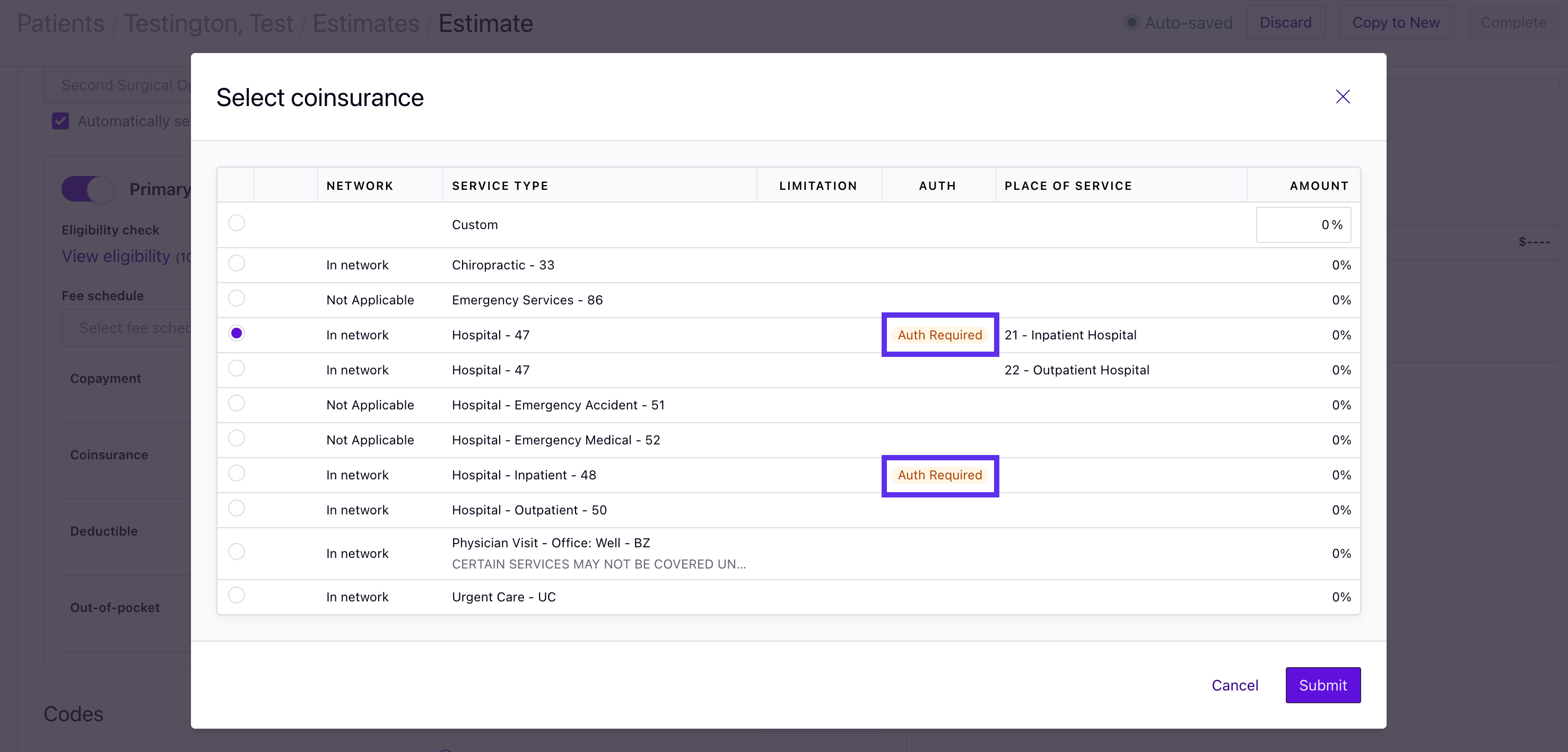

Minimize calls to payers with prior authorization alerts

Know if a particular benefit requires prior authorization (for payers who support this functionality).

Simplify your account structure with Business Units

View, analyze and manage your data and workflows for each contracted entity by connecting your fee schedules, service locations and claims to the correct line of business.

Improve rates + benefits accuracy with Service Locations

Rivet's Service Locations (that include corresponding Place of Service codes) offer more accurate rates and benefits for estimates by accounting for the type of location where services are being performed (e.g., inpatient, outpatient, office, etc.).

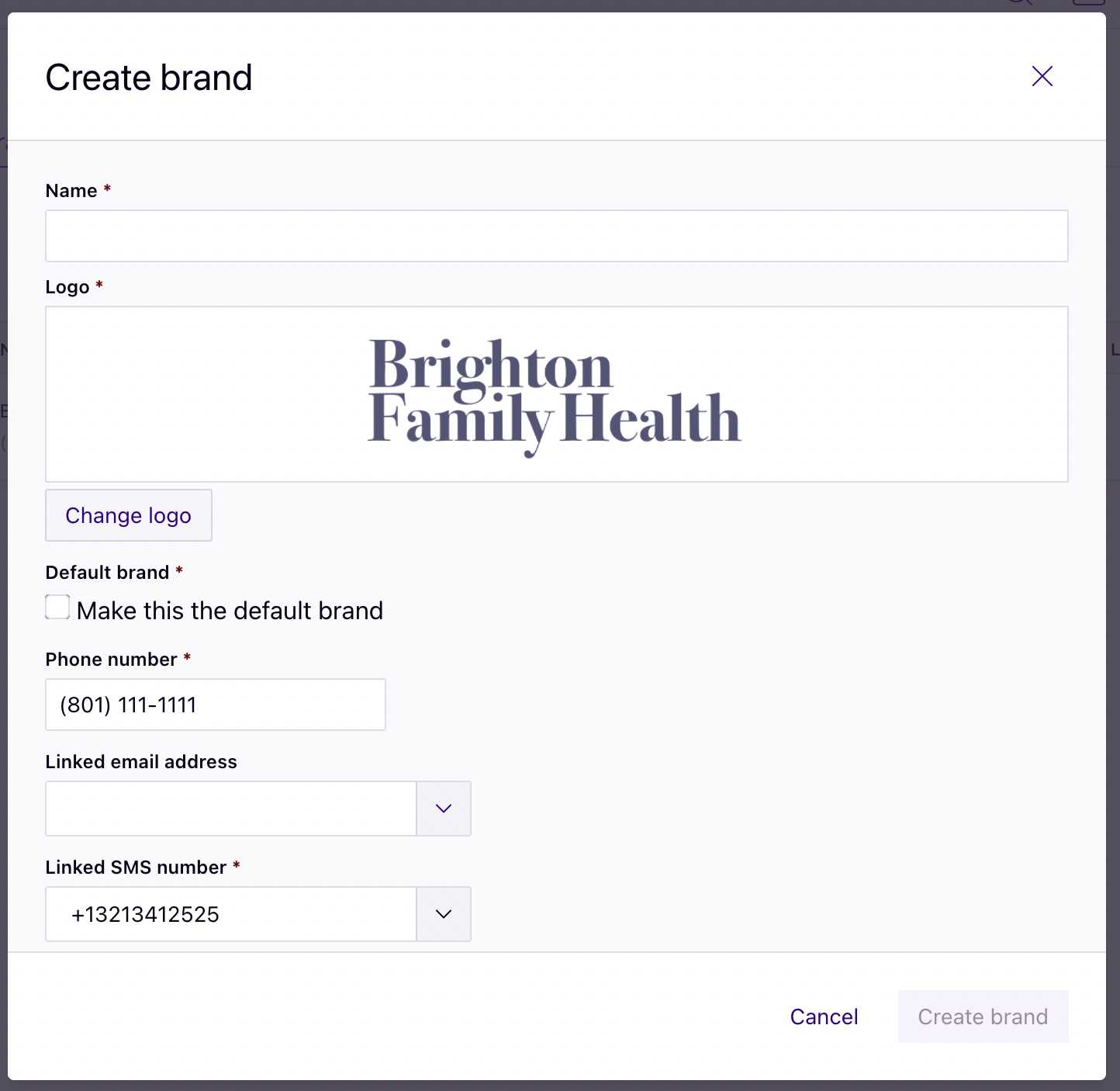

Create separate visual identities with Brands

Customize the appearance of estimates with Rivet’s Brands feature, independent of the physical location where service will be provided. Easily create separate visual identities for each provider group in your organization (e.g., Brighton Chiropractic, Brighton Orthopedics and Brighton Women’s Care), and select the desired brand in the Appearance section of the estimate.

Check eligibility with greater confidence

Make up-front payment easier for your patients

Other Significant Updates

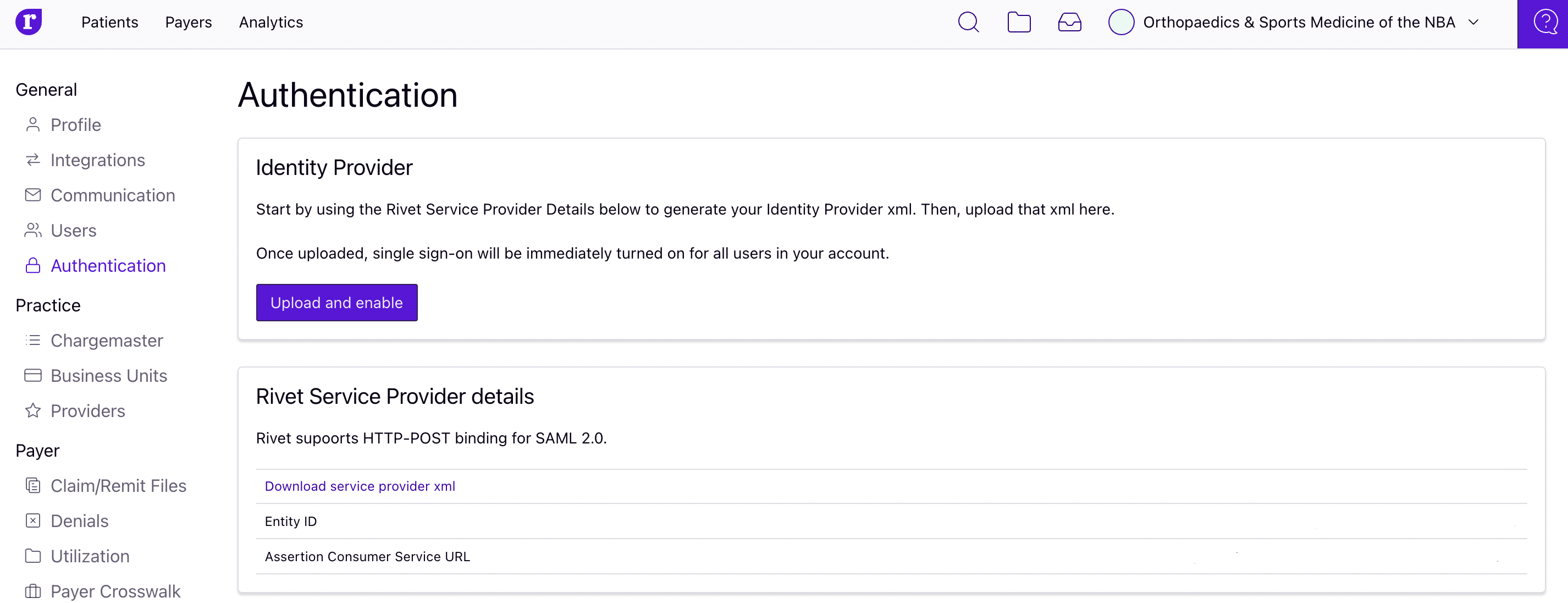

Log into Rivet more easily using Single Sign-on

Rivet supports single sign-on via SAML; meaning you can log in via an authentication system you already use, such as Active Directory. Visit the authentication page in your Rivet account settings or contact your Customer Success Manager to get started.

Resolve payment variance more effectively

Throughout the year we've made significant improvements to our underpayment calculation engine, upgrading your experience behind the scenes.

Enjoy Rivet more fully

We’re continuing to create new integrations and improve existing integrations with EHRs (e.g., athenahealth, Nextech and Greenway Health) to help Rivet seamlessly fit your needs.

Want to know more about Rivet's products? Download our one-page Rivet overview or schedule a demo.